The Mexican Energy Revolution

After decades of state control, Mexico opens its energy sector

November 20th is Revolution Day in Mexico – a national holiday celebrating the end of its ten year uprising against the dictator Porfirio Diaz. Also this month, Mexico will begin accepting bids on up to 6 million certificates for renewable energy, hoping to add up to 2,500 megawatts of clean electricity to its energy mix. It’s the latest step in a multi-year effort by President Peña Nieto to liberalize (and, according to some, revolutionize) Mexico’s energy sector and attract private investment. Changes to the Constitution at the end of 2013 reorganized the country’s energy regulatory agencies and secondary laws enacted by the legislature in 2014 opened the energy sector to private participation. One of Mexico’s energy goals for the near future is to increase the percentage of its energy use coming from renewable sources to 35% by 2024, but views differ as to whether the structural reforms will help or hurt Mexico in attaining that milestone.

Since the 1930’s, Mexico’s energy sector has been controlled by state agencies. Pemex, the state oil monopoly, controlled all oil production and fuel supply, while the Federal Electricity Commission (Comisión Federal de Electricidad in Spanish, or CFE) has operated the national grid (transmission and distribution) and almost all power generation and supply. There was some change in 1992 when private companies were allowed to invest in restricted amounts of generation projects, but transmission and distribution has always been state-owned and operated. Compared to many of its Latin American neighbors, Mexico has been relatively slow to join the energy liberalization movement.

Since the 1930’s, Mexico’s energy sector has been controlled by state agencies. Pemex, the state oil monopoly, controlled all oil production and fuel supply, while the Federal Electricity Commission (Comisión Federal de Electricidad in Spanish, or CFE) has operated the national grid (transmission and distribution) and almost all power generation and supply. There was some change in 1992 when private companies were allowed to invest in restricted amounts of generation projects, but transmission and distribution has always been state-owned and operated. Compared to many of its Latin American neighbors, Mexico has been relatively slow to join the energy liberalization movement.

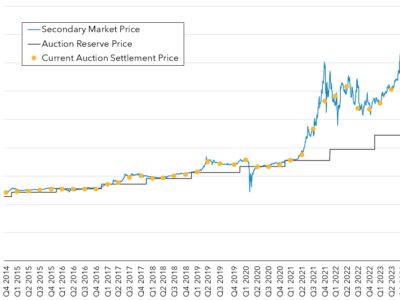

The new reforms introduce a number of changes designed to increase foreign private investment and to decrease electricity costs for industrial and manufacturing consumers. While the government greatly subsidizes personal electricity rates, industrial user rates are almost 80% higher than those in the U.S. This has stifled growth in energy-intensive manufacturing sectors, such as plastics. CFE lacks access to financing for infrastructure upgrades, and the country’s aging generation facilities have limited its ability to switch to cheaper energy sources like natural gas. The new energy laws open both the oil and electricity sectors to private sector participation and end the state monopolies of Pemex and CFE. CFE will be split into multiple smaller agencies, and there will be a wholesale market for electricity in which private companies can compete as both generators and suppliers. Governance of the wholesale electricity market and control of the electricity grid will move from CFE to an independent agency. So-called ‘qualified users’ (large electricity purchasers of over 3 megawatts at first, declining to 1 megawatt after three years) must register with the Energy Regulatory Commission (CRE), and if they purchase energy directly from the wholesale market, they must also acquire clean energy certificates.

Overall, these reforms are expected to generate a great deal of investment and competition in Mexico’s energy sector. However, whether that investment will be in renewable sources of energy is debatable. This past July, Mexico started auctioning off permits for oil exploration in the Gulf, and billions of dollars in gas pipeline plans are, well, in the pipeline. The requirement that qualified users acquire clean energy certificates provides an important inventive for investing in renewable energy sources. However, under the new law certificates are available for electricity from cogeneration, a technology based on natural gas, making the moniker “clean energy certificates” somewhat misleading.

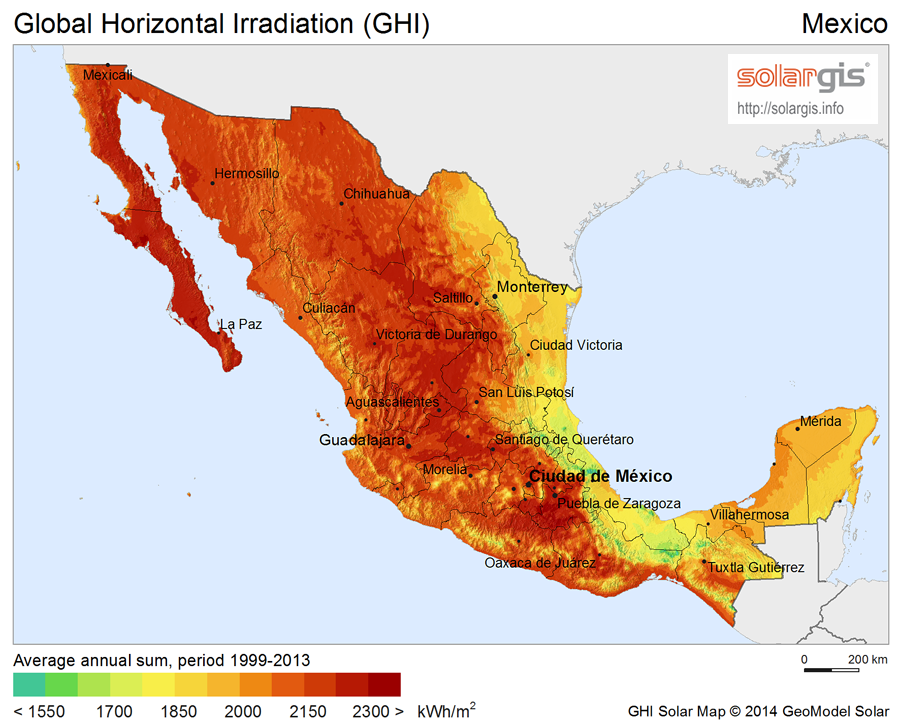

Still, many in the energy sector believe the added competition will advance Mexico’s transition to cleaner energy sources. There is a fair amount of hope and excitement surrounding the growing solar industry, and many believe these energy reforms will help Mexico become the next major solar market. Opening the wholesale electricity market and requiring qualified users to obtain clean energy certificates means that solar generators can market their product directly to customers, without having to go through CFE. The massive solar potential in Mexico coupled with multiple tax incentives has already attracted attention, and there are now 600 solar companies operating in the country. Foreign companies are also taking notice, with companies from France and the U.S. already setting up shop. If these trends continue, it might not be long until Mexico has a solar revolution.

Reader Comments

2 Replies to “The Mexican Energy Revolution”

Comments are closed.

Thanks , I’ve just been looking for info approximately

this subject for a long time and yours is the greatest I have found out till now.

But, what in regards to the bottom line? Are you certain about the supply?

Hi Nicholas, thanks for the comment! I’m not sure I can answer your questions without knowing more detail. What supply are you referring to? Electricity generally? Solar energy? If you’re asking about electricity supply stability, it’s hard to say what, if any, impact these reforms will have. The stability and reliability of an electricity supply depends on multiple factors, including demand response systems, backup generators, and more.