Defanging FERC’s Challenge to Renewables

The gird operator subject to the order has a plan to reduce its impact.

At the end of June, in a party-line vote, the Federal Energy Regulatory Commission (FERC) issued a sweeping order that seems designed to prop up coal. The order will impact electricity markets in a wide swath of the country. There’s been a lot of concern that the order might seriously impact renewables. But PJM, which operates the grid serving 65 million customers, has proposed a narrow interpretation of the order that would blunt much of its impact. As I’ll explain, FERC will be under a lot of pressure to accept the plan that PJM comes up with.

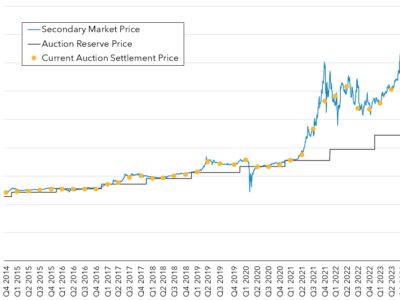

This gets pretty wonky, but here’s some quick background: PJM runs markets in its regions for electricity generators and utilities. One market covers sales of electricity. Another market, called the capacity market, is supposed to compensate generators for their capital costs and ensure that there’s an incentive to build new generators where necessary. FERC claimed it was concerned that state subsidies for renewable generators and a few nuclear generators were allowing them to submit artificially low bids, resulting in low prices in the capacity market. FERC’s fix has two parts: (1) adding a surcharge to bids by those generators, in order to offset the subsidies, (2) exempting these generators and their output from the capacity market if utilities agree to buy their power. The fear is that the surcharges would lock solar and wind out of the market by pushing their bids too high, whereas the exemption might not be very workable. (If you’re interested in more detail, take a look at this earlier post.)

PJM’s argues for a narrow interpretation of the order that would limit its impact on renewables. PJM argues that the order should apply only to generators receiving cash payments in some form, either from the state or from selling renewable energy credits, not to those generators who are helped by renewable energy quotas placed on utilities (call Renewable Portfolio Standards or RPS). PJM also argues that the order should not cover utilities in states that regulate their prices and operations, nor to utilities that own their own generators. In terms of the surcharge, PJM also argues that the effect on existing renewable generators will be limited because they are already subject to price adjustments under its current operations.

Finally, PJM says it is especially interested in comments about whether Trump’s proposed bailout for coal plants should trigger the same kinds of treatment for those plants as FERC proposes for renewables. It would be ironic if the FERC order comes back to bite the coal industry, which was its biggest advocate. But if FERC treats the Trump bailout like renewable subsidies, that will sap its strength. And if they fail to do so, it’s going to be hard to explain why only one kind of subsidy distorts the markets unacceptably.

FERC will be under pressure to accept PJM’s interpretation rather than delay the process with a major rewrite. There are two reasons for FERC to seek a speedy resolution. First, in August, it will lose one GOP member, leaving a 2-2 split on the commission. Second, delays will make it difficult for PJM to restructure its rules in time for the next capacity auction. So there’s some hope that the upshot of the FERC order will be relatively mild. Given the importance of reducing carbon emissions in this big chunk of the country, that would be a really good thing.

Reader Comments

2 Replies to “Defanging FERC’s Challenge to Renewables”

Comments are closed.

I’m worried about a new Supreme Court being receptive to dormant commerce clause arguments aimed at state renewable portfolio standards, especially to the extent that they ban imports of coal-fired electricity. The DCC is on page 1 of the polluters’ playbooks now.

David,

That’s definitely a worry. Gorsuch wrote a good opinion upholding the Colorado RFP when he was on the 10th Cir., which might be a good sign. No way of knowing what Kavanaugh thinks, since the DC CIrcuit doesn’t get those. And Thomas is anti-DCC. So there are some grounds for thinking that there wouldn’t be a drastic overnight change on the Court. Adding all those conservative court of appeals judges doesn’t help, however.