Second California cap-and-trade auction sells almost $225 million worth of allowances

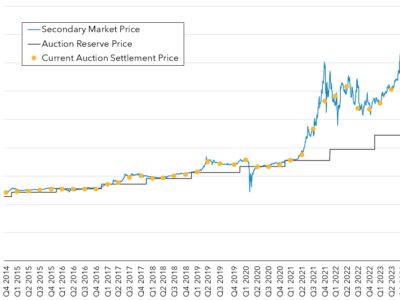

Results are in from California’s second cap-and-trade auction. California Air Resources Board (CARB) offered 12.9 million 2013-vintage allowances along with 9.56 million 2016-vintage allowances. CARB sold all of the 2013 vintage at $13.62 per allowance and almost half (4.44 million) of the 2016 vintage at $10.71 per allowance. In total, that amounts to a bit more than $223 million.

Results are in from California’s second cap-and-trade auction. California Air Resources Board (CARB) offered 12.9 million 2013-vintage allowances along with 9.56 million 2016-vintage allowances. CARB sold all of the 2013 vintage at $13.62 per allowance and almost half (4.44 million) of the 2016 vintage at $10.71 per allowance. In total, that amounts to a bit more than $223 million.

For two auctions in a row, California sold all available current-year vintage allowances. Less compliance entities purchased allowances, as a percentage, meaning that there were likely more sales to investors / brokers. (3% went to entities without compliance obligations in the first auction, compared to 12% in this auction.) And the price for current year auctions increased from $10.09 to $13.62 over the past two auctions. This higher price better reflects the price seen in trading happening on the spot market (mainly futures and options trading for allowances).

Again, California did not sell all available future-year vintage allowances. Thus, future allowances were sold at the reserve price of $10.71. As a percentage, CARB sold significantly more future-year allowances but about the same amount by volume. I would guess that there are a limited number of buyers with the resources to estimate their need for (and funds to buy) allowances for use several years down the road. In this auction, all of the future-year allowances went to compliance entities.

In the last auction, Edison International “submitted a proposal in the wrong format and offered to buy 21 times more allowances than it wanted on Nov. 14.” According to Bloomberg, this accounted for 72% of the offers. As a result, Edison purchased 1.61 million more permits (at $10.09 each) than it really wanted. Because CARB verifies bids against holding limits, purchase limits and bid guarantees, Edison’s screw-up did not affect the auction (although it may have affected someone’s future employment prospects). Of course, Edison may end up with a bit of a windfall, as the most recent auction price reflects a 34% increase over Edison’s purchase price.

In this auction, CARB’s summary mentions that some bids would have been rejected for exceeding their bid guarantee had the auction settled at the reserve price of $10.71. In other words, a few bidders threw in some bids at the reserve price without properly considering if they had enough funds, as reflected in their bid guarantee, to pay for all of it. This, again, did not affect auction results, but does show that some companies need to hire some mathematicians.

Reader Comments

2 Replies to “Second California cap-and-trade auction sells almost $225 million worth of allowances”

Comments are closed.

I wrote a song about cap n’ trade:

Gee whiz, California gonna save us from climate change. ha ha ha

Gotta get me some of those carbon credits. cha cha cha

Feelin better already.

california carbon credits

full moon rising, dogs are howling

give me credit, lots of credit, under starry skies above.

cha cha cha

ha ha ha

I wrote a song about cap n’ trade:

Gee whiz, California gonna save us from climate change. ha ha ha

Gotta get me some of those carbon credits. cha cha cha

Feelin better already.

california carbon credits

full moon rising, dogs are howling

give me credit, lots of credit, under starry skies above.

cha cha cha

ha ha ha