A Bridge Made of Natural Gas Is a Shaky Thing

When will we start to manage our natural gas resources?

For the last half century, domestic natural gas policy has looked something like this: Natural gas is the cleanest of the fossil fuels. It is versatile and economical. So, let’s pull it out of the ground and use it as fast as we can. In the last decade, the policy has been appended to include the notion of natural gas as a bridge fuel – in some situations, it emits half as much greenhouse gas as does coal, so let’s use gas as a lower-carbon fuel that can tide us over until we find a better way.

This is proving to be a risky strategy. Companies across the country keep building more and more power plants that rely on natural gas, while gas producers want to increase export capacity to take advantage of foreign markets. These are infrastructure investments that are designed to pay off over decades, spanning years during which we must drastically reduce reliance on all fossil fuels – gas included – if we have any hope of meeting long-term greenhouse gas reduction targets. Meanwhile, the greenhouse gas implications of using natural gas cover the entire life cycle of gas extraction and use – not just what gets emitted at the smokestack. Methane leaks at the wellhead and along the pipelines release potent greenhouse gases in quantities that are not easily measured but certainly reduce the potential climate benefits from switching to natural gas. Liquefying and transporting gas for exports also emits additional greenhouse gas.

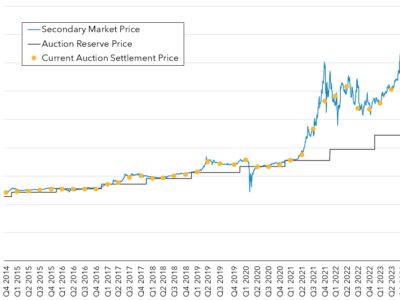

In the meanwhile, increased reliance on natural gas threatens domestic energy budgets and undermines grid reliability. In the face of cheap hydro-fracked natural gas, electricity generators have increased reliance on the fuel. Yet, this winter, gas prices have almost doubled, dragging electricity charges along with them. Over the last few days, the effect on electricity prices has been much more dramatic in eastern states that have competitive power markets, as they continue to struggle with harsh winter weather. This has put a temporary strain on flowing gas supplies and power purchase prices have hit the panic level. Power that normally might demand $35-50 per megawatt hour has sold at times for over $1,000.

Even in temperate California, the stability of the grid has been threatened. With more pipeline gas needed in the east, flowing supplies to California have been limited. Yesterday, the state’s grid operators issued a flex alert, asking customers to limit their use of discretionary lighting and appliances so that the inability to rely fully on gas-fired power plants would not lead to a grid-crashing imbalance between the supply of electricity and the demand.

To mix a metaphor, it is hard to build a stable bridge when you have too many of your eggs in one basket. Just as smart farmers know that it is risky to rely on a monoculture, so do smart grid operators. What energy policy makers could do is acknowledge, for the first time, that natural gas is a finite resource that must be strategically managed. They could plan for an expanded mix of renewable fuels, demand management, and energy storage. Or they could stay on the current trajectory of making new gas infrastructure investments and deal with the consequences later.

Reader Comments

2 Replies to “A Bridge Made of Natural Gas Is a Shaky Thing”

Comments are closed.

California is suffering because its regulatory system precludes the development and construction of new power plants

And in any case in pure energy terms, gas will never provide the energy currently provided by oil, let alone the one currently provided by oil + gas, according to Laherrère projections (amongst others) at least :

http://iiscn.files.wordpress.com/2014/02/jl-all-2013.jpg