Why Pollution Regulations Aren’t Taxes

Opponents of environmental regulations love to call them hidden taxes. But constant repetition doesn’t make this idea true.

If you’ve seen a statement that regulations are hidden taxes, that’s not too surprising. Googling “regulation hidden taxes” produces over three million hits. But in fact, pollution regulations and taxes are completely different.

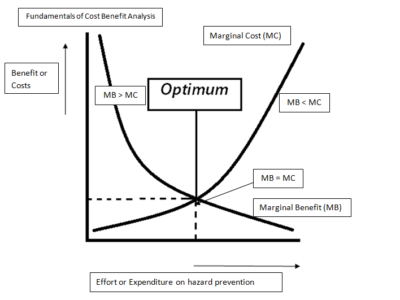

The reason is simple. A tax removes value from the private sector. Environmental regulations simultaneously remove value from one part of the private sector and increases value elsewhere (usually in the form of improved health). Both effects have to be considered in tandem. Well-designed environmental regulations actually make the private sector as a whole better off.

The difference between taxes and regulation is also important if we think in terms of rights. A tax is an incursion into property rights — a necessary incursion but still an incursion. But an environmental regulation has dual effects. On the one hand, it restricts the polluter’s right to make use of its property — but on the other hand, it protects the rights of individuals not to be exposed to harmful substances without their consent. We can also think of this in terms of property rights. For instance, pollution regulations define” ownership” of the atmosphere as a resource, determining the boundary between the rights of emitters to use the atmosphere to dispose of waste and the rights of members of the public to use the atmosphere as an air supply.

If compliance costs indirectly raise the cost of consumer products, a potential side-effect is to reduce the incentive to work since the same amount of wages will buy fewer consumer goods. People might also invest less, since their investment returns won’t buy them as much. But it’s not clear that this is something we should worry about with pollution regulations. A healthier population will be more productive and willing to work more than a sickly one. And if regulation reduces premature deaths, people have a greater incentive to save for retirement and more of an incentive to invest in human capital as well.

Particular regulations may be good or bad. If a particular regulation is a bad idea, we shouldn’t have it. But that’s not because it’s like a tax. It’s because we should favor good regulations, not bad ones.

Reader Comments

3 Replies to “Why Pollution Regulations Aren’t Taxes”

Comments are closed.

Dan,

An interesting post and thought provoking post. Instrument choice is what we do and it’s good to return to fundamentals every once in a while.

I would add a another dimension to your analysis. I usually think about the choice between prescriptive regulation, emissions taxes, or marketable permits as one that has to do with the availability of information. How much is available (foresight of various factors, knowledge of marginal abatement cost curves, technological and work practice changes to reduce emissions, etc)? Who has the information (regulators, industry, broadly dispersed social networks)? And what is their incentive to disclose the information fully and truthfully in the regulatory process? Particularly in a rapidly developing and technologically innovative economy, reaching clear answers about the “knowledge problem” is a key to sound regulatory policy.

Happy holidays!

-MW

Hi Michael. I was trying to think in terms of some of the arguments made by “small government” people against regulation. I agree with you in pragmatic terms about instrument choice. Thanks as always for your comment!

Dan

Hi Dan,

Well it depends on which small government types we are talking about. If one is dealing with people who are (a) both sincere in their wish to maximize social welfare, however those cards fall but (b) deeply skeptical of the governments ability to do things well, then emphasizing the issues around information might be important. I think a Hayekian Libertarian – Russ Roberts comes to mind – would be much more comfortable with an emissions tax than with a prescriptive regulation. That’s because it is less intrusive into people’s or firms activities – they are still “free to choose” but must do so within a market framework that holds them fully accountable for their choices. At the same time, emissions pricing doesn’t privelege judgments that the regulator (or the regulatory process) has to make about how to reduce pollution.

Their metaphor, right or wrong, that many of these people have for prescriptive regulation is misallocation of resources in state planned communist economies. So policies that say – let disaggregated processes not subject to political rent seeking decide as much as possible – are to be favored.

But maybe Austrian academic economists aren’t really your target audience either… 😉

Warmly,

Michael