How Should We Implement the New Federal Climate Laws?

An upcoming symposium by the Emmett Institute will explore the key climate impacts of IIJA and the IRA and unpack some of the obstacles and controversies around their implementation.

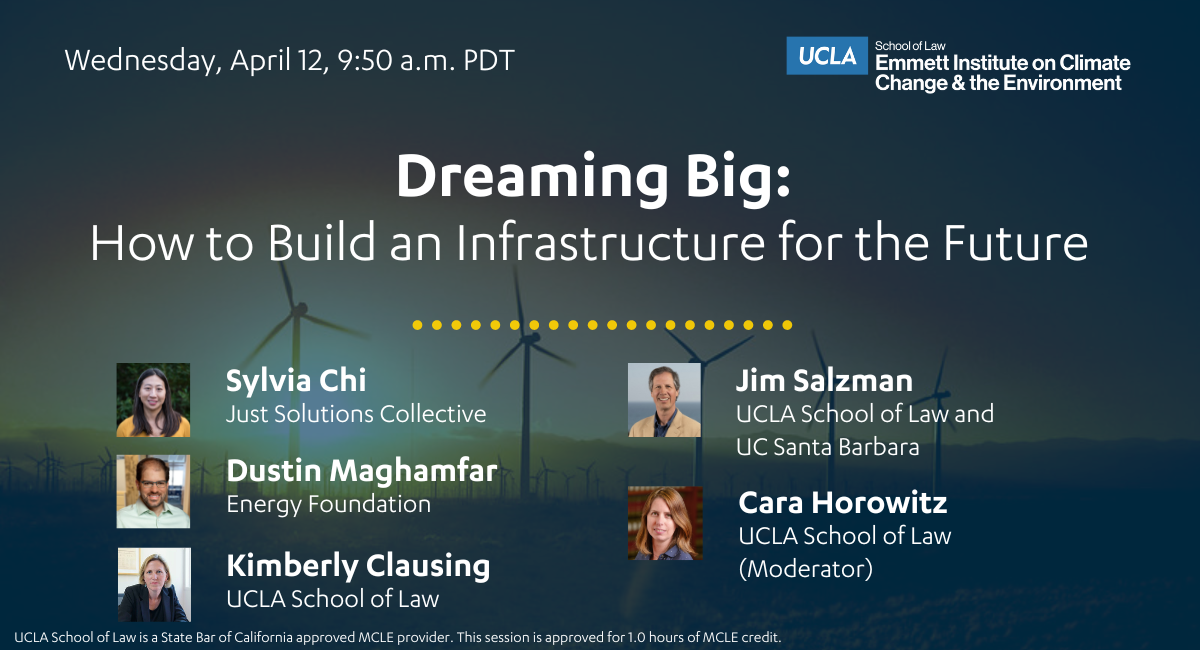

This is the first of a series of posts previewing the Emmett Institute’s 2023 Symposium, coming up on April 12. Check out the second post, on transmission infrastructure, and the third post, on transportation; and RSVP for the Symposium here!

The Infrastructure Investment and Jobs Act of 2021 (IIJA) and the Inflation Reduction Act of 2022 (IRA) represent a radical change in federal climate policy. A lot of this is the scale of funding—the two laws will spend money on climate policies at a far higher rate than any previous federal programs—but the laws will also involve the federal government more in climate policy, in a variety of ways.

These changes come at a crucial time for the fight against climate change. As the latest report from the Intergovernmental Panel on Climate Change puts it, “Rapid and far-reaching transitions across all sectors and systems are necessary to . . . secure a liveable and sustainable future for all.” And with divided government at the federal level, these laws may well be the last nationwide legislative actions on climate change for years.

For these reasons, we’re focusing on the climate impacts of the IIJA and the IRA for our 2023 Symposium—Make or Break: Transforming U.S. Infrastructure to Meet Climate Goals—on Wednesday, April 12. We’ll be convening some of the top experts in the country for three panels: one on general design and implementation questions, one on building an electricity-transmission system to meet the demands of transitioning to renewable energy, and one on decarbonizing our transportation infrastructure.

And I’ll be using this space weekly to highlight some of the big questions each panel will be discussing. Today I’ll be talking about our first panel, Dreaming Big: How IRA and IIJA Can Help Build an Infrastructure for the Future.

Overview of the IIJA and IRA

But first, a quick overview of these two laws: The IIJA—sometimes called the “Bipartisan Infrastructure Law,” or “Uncle BIL”—authorizes hundreds of billions of dollars in spending; the Brookings Institute estimates about $864 billion in total. Most of this money goes to transportation, with the largest share to roads and bridges, and substantial amounts to public transit and zero-emissions transportation options, as well. The IIJA also provides tens of billions of dollars to energy infrastructure, particularly to carbon capture and storage, hydrogen development, and battery manufacturing.

The IRA is a similarly massive bill. The Committee for a Responsible Federal Budget assesses its spending to be around $485 billion, of which around $386 billion goes to climate and energy programs. The IRA’s funding is notable for providing enormous amounts of tax credits and rebates for clean energy, buildings, and transportation. It also provides tens of billions of dollars for decarbonizing other sectors, including industrial manufacturing.

One major feature of both the IIJA and the IRA is their use of incentives rather than mandates—carrots rather than sticks, in other words. To a certain extent, this is because of political and procedural constraints: The IIJA relied on center-right supporters, such as the U.S. Chamber of Commerce, which might not have supported the bill if it imposed significant new climate mandates, while the IRA was passed through “budget reconciliation,” a process which essentially restricted the law to changes in spending and taxation only. But whatever the reason, the two laws will test the federal government’s ability to buy its way into a decarbonized economy.

With that said, the IIJA and IRA do have some provisions that go beyond funding. The IIJA has several provisions meant to speed up fossil-fuel extraction and infrastructure development—it requires the federal government to hold lease auctions for energy extraction on public lands, as we’ll see later on, and it also tries to streamline federal permitting processes for infrastructure development.

Similarly, as our panelist Dustin Maghamfar has written, the IRA amends the Clean Air Act in ways that will have a qualitative impact. It creates a $20 billion “green bank,” meant to create sustained funding sources for smaller-scale climate action, charges fees for methane emissions for the first time, and confirms existing EPA climate authorities that have been challenged in court.

Key Questions and Controversies

With introductions out of the way, we can talk about some of the high-level issues that are cropping up around the IIJA and IRA.

Equity and Climate Justice

One major question is how these bills will fit into the broader need for more equitable climate policy. The Biden administration’s Justice40 Initiative, which aims to direct 40% of direct federal climate spending to “frontline communities” and require meaningful community input on federal programs, is a core part of this effort. But this probably doesn’t mean that hundreds of billions of dollars are going to frontline communities: Only about 15% of IIJA funding is restricted to frontline communities, and only about $60 billion of IRA climate spending is even subject to the Justice40 set-aside, with the remainder going to tax credits and rebates.

The IRA’s focus on tax credits and rebates themselves raise an equity question, as our panelist Sylvia Chi has pointed out. The benefits from energy tax credits tend to flow to Whiter and wealthier populations. Rebates have the potential to be more equitable, but only if the federal government takes steps to direct them toward tenants, people with low or no income, and communities with high pollution burdens. Otherwise, they risk being used up by better-resourced households and communities that can access them more easily.

A further key question here is the extent to which race and ethnicity, specifically, will be acknowledged in climate funding. Although Black and Brown people are disproportionately exposed to environmental and climate harms, and therefore are disproportionately represented in “frontline communities,” the federal government has tight restrictions on race-based legislation—recently exemplified in the litigation over the American Rescue Plan’s attempt to forgive loans to Black farmers. Implementation of the IIJA and IRA, therefore, must find a way to account for historical inequities without tying up funding in unnecessary litigation.

The Role for Fossil Fuels in the Climate Transition

Another fiercely debated question is how, and for how long, fossil fuels will be used during the transition to a carbon-free economy. Perhaps the most obvious example of this is the IRA requirement that the Department of the Interior hold sales of offshore oil and gas leases that it had cancelled, and making offshore-wind leasing contingent on holding additional auctions. While auctions will not necessarily translate into new development of these resources, it is nonetheless a step backward in the minds of many climate advocates.

There’s also the significant support in both the IIJA and IRA for programs that will likely extend the role of the fossil-fuel industry. The IIJA provides about $12 billion for carbon capture and storage (CCS), while the IRA makes the existing “45Q” tax credits for CCS both more valuable and easier to use than they had been previously. Both programs also support the development of hydrogen: The IIJA earmarks $10 billion for hydrogen programs, mostly for creating “hubs” linking hydrogen production to facilities that use it, while the IRA creates a new “45V” tax credit for hydrogen production. For both laws, the hydrogen must be “clean” to benefit, but that designation includes hydrogen made with fossil fuels and CCS, and in any case, even hydrogen made with renewables may wind up being mixed with natural gas for use in converted gas plants, rather than in zero-emission fuel cells.

These provisions highlight an important conflict playing out in climate policy between using traditional fossil-fuel power mitigated with new technologies, on one hand, or pushing for a rapid conversion to renewable energy and electrification of fossil-fuel end uses, on the other. The resolution to this tension will have economic impacts, but will be much broader, since fossil fuels have immense social, equity, and health impacts.

Trade War or Race to the Top?

The last point for this post (but by no means the last question raised by the new legislation) is how the IIJA and IRA will impact global trade. The IIJA also creates substantial new “Buy America” requirements for its funding, and for future infrastructure funding, that require construction materials and manufactured products to be made in the U.S. The IRA, meanwhile, links many of its subsidies to local-production requirements, either requiring that materials or products are sourced in the U.S., or offering substantially greater benefits when they are.

This embodies the “next generation” trade disputes over environmental policies, as our panelist Jim Salzman has described it: Previous environmental laws imposed trade restrictions to try to prevent environmental harms overseas, like import bans on products that could harm protected species. But these laws are more like a green industrial policy, trying to jump-start climate manufacturing and extraction domestically—which could look like trade discrimination from abroad.

One possible result is that other countries will try to match the U.S.’s subsidies to support their own climate economy, creating a beneficial “race to the top”. This seems particularly possible in Europe, as our panelist Kimberly Clausing explored in a recent interview. But some worry that countries with less capacity for those subsidies will be left behind, impacting their ability to participate in the accelerating green economy.

Coming up Next

There’s much, much more to explore on these topics, and we’ll all get a chance to dive into it with our panelists on April 12, at 9am. And please check back next week for a preview post on our second panel, Transmission Case Study: Remaking our Power Grid for Renewable Energy!

Reader Comments