Is Romney Building Sand Castles Based on Fantasy Oil and Gas Production?

I posted yesterday about Romney’s energy plan, which makes some remarkable claims about future energy production and its economic benefits. If you look at the sources cited by the campaign to support this plan, the campaign seems to rely heavily on Citigroup report called Energy 2020: North America, the New Middle East?. A number of their other sources are basically just touting the Citigroup report.

I’m planning to dig into Citigroup’s economic projections more, but there also seem to be real questions about their energy projections. At least, some very credible questions have been raised about their optimistic projections for future energy production. In fact, the report raised some questions even in business circles:

“Whether the report proves prescient or just another starry-eyed fantasy remains to be seen.”

The Oil Drum carefully reviews Citigroup’s projections about future production. The conclusion is that they’re wildly optimistic. Here’s an example:

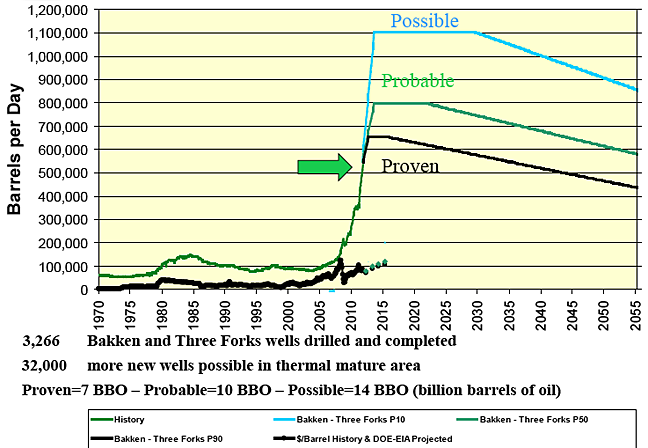

Citigroup uses the light blue “possible” line. Basing your planning what you think may be possible is a bit risky, and I have to wonder if they make their own investment decisions and advise their clients on a similarly optimistic basis.

Another key point to see about this graph is that each line shows a decline after the initial surge. This is really a key point. As the Oil Drum p0ints out, the “declining production from existing and future wells that appears to be neglected in the Citigroup study.”

The reason is fairly simple:

Those plays which will yield rapidly in generating high initial well production will, in turn, be the first that decline significantly and need replacement. Yet replacement will, over time, have to be in poorer parts of the formation, requiring that multiple wells replace the initial producer, and so bounds on production will be reached, likely before the end of the decade. Citigroup anticipates that the risks in development of the shale plays, whether in Texas or California, come as much from an inability to transport the oil generated and from environmental policy; they see few geological risks – which is a pity, since it is the geology that will control production and its decline, and the ultimate profitability of these ventures.

I’m not a petroleum engineer or a geologist., so I’m certainly not going to pick sides in this dispute. It does seem like the Romney team is basing their energy plan on some very optimistic projections for the potential of future energy production.

That kind of optimistic is probably fine on the part of the folks who drill wildcat wells. It keeps them hopeful even when they hit dry hole after dry hole. But is it a sound basis for a major national policy?

Reader Comments