climate and insurance

Building Climate Resilience in California’s Insurance Sector

New report recommends strategies to prepare industry for a changing climate and economy – plus interview with Insurance Commissioner Lara

California’s insurance sector faces significant risks from climate change. These include both the transition risks facing all financial institutions as the global economy shifts toward decarbonization, and the singular combination of physical risks–wildfire, drought, coastal hazards, extreme heat—that threaten California’s communities and businesses. Accurately assessing these risks will be vital to ensuring the long-term viability …

Continue reading “Building Climate Resilience in California’s Insurance Sector”

CONTINUE READINGInsurance Regulators Commit to TCFD-Aligned Risk Disclosure Survey

Updated survey signals greater industry focus on climate risks

Two weeks ago the National Association of Insurance Commissioners (NAIC) took a significant step in the assessment and disclosure of climate-related financial risk by updating its insurer climate risk survey to reflect the recommended disclosures of Task Force on Climate-Related Financial Disclosures (TCFD). The TCFD recommendations are widely recognized as a leading international standard for …

Continue reading “Insurance Regulators Commit to TCFD-Aligned Risk Disclosure Survey”

CONTINUE READINGRisky Business

Climate Change and the Insurance Sector

Founded in 1871, the National Association of Insurance Commission represents insurance regulators in all fifty states. It’s not a particularly woke group – the current president is the Director of the Idaho Department of Insurance. However, the group has just issued a new “voluntary” survey for insurance companies about climate risks. “Voluntary” is in quotes …

Continue reading “Risky Business”

CONTINUE READINGInsuring Extreme Heat Risks: Q+A with CA Insurance Commissioner Ricardo Lara

Insurance Commissioner answers questions on insurance and extreme heat issues

Yesterday, CLEE released Insuring Extreme Heat Risks, which investigates the potential for insurance and other financial risk transfer mechanisms to address the multi-faceted and growing risks that climate change-related extreme heat poses to public health, infrastructure, educational and labor productivity, and other vital systems. California Insurance Commissioner Ricardo Lara, who provided vital support for the report …

Continue reading “Insuring Extreme Heat Risks: Q+A with CA Insurance Commissioner Ricardo Lara”

CONTINUE READINGAddressing Extreme Heat Risk with Insurance

New report assesses potential for innovative insurance solutions to support response and mitigation

This past summer, California suffered through a record heat wave with triple-digit temperatures throughout the state that helped spark the record-setting wildfires that left millions of acres burned, thousands of people displaced, dozens dead or missing, and millions breathing toxic air. But extreme heat is a climate killer in its own right, responsible for thousands …

Continue reading “Addressing Extreme Heat Risk with Insurance”

CONTINUE READINGNew Report: California Climate Risk and Insurance

UCLA & UC Berkeley Researchers Issue Report on Climate Change and Insurance in California

(This post is part of a series on the issue of climate change and insurance that my colleague Sean Hecht and I are writing, inspired by a symposium that the law schools co-organized with the California Department of Insurance earlier this year. You can find more information on the symposium here. My initial post is available …

Continue reading “New Report: California Climate Risk and Insurance”

CONTINUE READINGHow Does Increasing Wildfire Risk Affect Insurance in California?

Affordability and Availability of Wildfire Insurance Are Less Stable Under Changing Conditions

(This post is part of a series on the issue of climate change and insurance that my colleague Ted Lamm and I are writing, inspired by a symposium that the law schools co-organized with the California Department of Insurance earlier this year. You can find more information on the symposium here. Ted’s prior related post …

Continue reading “How Does Increasing Wildfire Risk Affect Insurance in California?”

CONTINUE READINGClimate Change and the Insurance Sector: An Overview

The Insurance Industry Grapples With Changing Risks in a Changing Climate

(This post is part of a series on the issue of climate change and insurance that my colleague Ted Lamm and I are writing, inspired by a symposium that the law schools co-organized with the California Department of Insurance earlier this year. You can find more information on the symposium here. Ted’s prior related post …

Continue reading “Climate Change and the Insurance Sector: An Overview”

CONTINUE READINGBuilding Climate Resilience through Insurance

New insurance products may offer innovative adaptation solutions

(This post is part of a series on the issue of climate change and insurance that my colleague Sean Hecht and I are writing, inspired by a symposium that the law schools co-organized with the California Department of Insurance earlier this year. You can find more information on the symposium here.) The autumn of 2019 is bringing …

Continue reading “Building Climate Resilience through Insurance”

CONTINUE READINGNew Report Co-Authored with California Department of Insurance Analyzes Climate Risks to Insurance Industry

Climate change threatens the industry’s viability right when it is needed most. The new report from CDI and CLEE outlines key risks and opportunities for insurers, regulators, and residents.

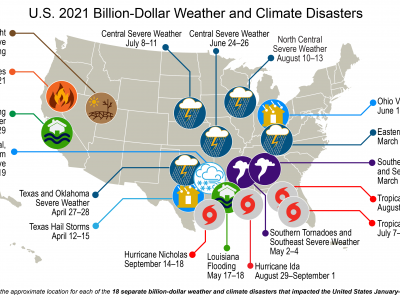

Climate change presents a wide range of risks to California’s insurance industry, as Californians across the state contend with unprecedented wildfires, changing storm patterns, increased risks of flooding and sea level rise, and disruptions to business from agriculture to fisheries and beyond. Potential decarbonization of the economy and litigation based on climate-related damages further threaten …

CONTINUE READING