Free Allowances! Get Your Free Allowances!

From WashPo,

The Obama administration might agree to postpone auctioning off 100 percent of emissions allowances under a cap-and-trade system to limit greenhouse gas pollution, White House science adviser John P. Holdren said today, a move that would please electricity providers and manufacturers but could anger environmentalists.

Why would this “anger environmentalists’? I certainly see the fiscal arguments for auctioning allowances, but I don’t get why auctioning makes a difference in environmental terms. Am I missing something?

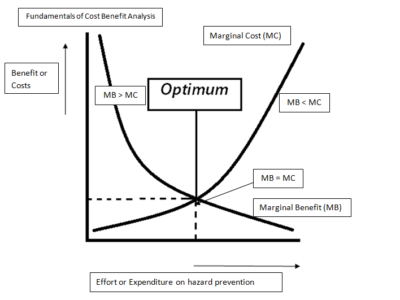

ADDENDUM The comments to this post make two interesting points that I think are connected. One is that free allowances don’t put a price on carbon. I don’t think that’s quite right. Unless allowances are overallocated, there won’t be enough to allow everyone to continue emitting at their previous level, so there will be either an explicit price (from market trades) or an implicit price (from intra-firm trades or opportunity costs of foregone sales). It’s possible that firms don’t experience the implicit prices as strongly as explicit prices, but the real strength of the argument seems to come from the possibility of overallocation.

The other point strikes me as more compelling: that as a public choice matter, free allowances increase the pressure to issue additional allowance since they won’t cost anything to the recipients, thus leading to over-allocation of allowances (i.e., too high a cap). Again, there’s an implicit price (existing allowances in the hands of industry lose value), but probably this won’t be an effective deterrent. This seems plausible, and it’s something I should have thought of myself since I do work in public choice.

I’d still be interested to know if there’s a history of this actually happening in other trading schemes. In any event, I’m not sure that this is something I’d go to the barricades over, even if these points are valid.

Reader Comments

9 Replies to “Free Allowances! Get Your Free Allowances!”

Comments are closed.

Yes. Free allowances, by definition, don’t put a price on CO2 emissions and so don’t incentivize reductions. A related issue is the problem of over-allocating reductions, a problem that damaged the European cap and trade scheme.

Oops. I meant over-allocating allowances.

Dan, I think David’s got it right that free allowances are linked to the over-allocation problem. If allowances are free, everyone will take as many as they can get, and demand more. Nothing pushes back against the political pressures to over-allocate. If users have to pay for allowances, their pocketbooks will impose some limit on the demand, making it easier to impose a realistic emission cap.

Environmentalists might, in addition to being environmentalists, have a sense of justice that would lead them to “anger” over a) large emitters’ continued escape from the costs of their externalities (petty, perhaps, but real) and b) the regressivity that results from the “tax” that accrues under either allocation scheme (via the prices Prof. Farber discusses in the addendum) but can only effectively be mitigated through a rebate funded by an auction (less petty). Is (b) what Prof. Farber meant by “fiscal” arguments for an auction?

To say that allocating allowances for free will lead to there being no price on emissions is to conflate the setting of the cap with the allocation mechanism. In the SO2 program from the 1990 Clean Air Act Amendments, for instance, “free” allowances have set a price on SO2 emissions that has been consistently above “free” (ranging from $100 to $600 per ton or more). These are real costs for power plants. In addition, there has been no meaningful push to expand the supply of allowances in this program, that I’m aware of, nor am I aware of any other attempt to expand allowance supply for any other emissions trading program that is linked to the allowances being distributed for free. Indeed, the many “safety valves” and other new innovations in more recent cap and trade proposals seem to suggest that it is more likely the cap will be expanded (and more allowances created) as a response to allowances selling at a certain price on the market.

In addition, my understanding of what happened to EU allowance prices is that there was an over allocation, which is a problem, but more importantly there was no “banking” of allowances permitted which meant that anyone who didn’t use or sell an allowance by the end of the first phase of the program had an asset worth nothing. Prices plunged as the end of the first phase of the program approached for this reason. I believe the EU now allows banking of some allowances to avoid this problem.

The moral? Setting a good cap, and providing for a mechanism to lower the cap over time, is vital to a successful program. The reason environmentalists should be concerned about free allocation is that it produces major potential profits for at least some polluting firms, rather than an auction which, in theory, can recirculate revenue from the sale of permits back to consumers facing higher energy prices. This was one of the major reasons offered for an auction under the RGGI program.

Leigh Raymond,

I’ve read that SOX has declined 25% under 17 years of cap and trade. This seems like rather modest progress. Do you know if the number of allowances declines over time?

It seems to me that the free allowances would benefit high carbon states/regions at the expense of energy efficient states like California. It also seems like the free allowances would reduce the effectivness of cap and trade–Am I wrong about this?

@ Red Desert

The SO2 allowances did decline over time, up to 2010 when they hit their lowest annual level. I think the reduction may have been more than 25% – although depends on from what baseline. The 2004 EPA report says that SO2 emissions were down 34% from 1990 levels as of then – I don’t have a more recent one on hand. The 2010 cap was set as a 50% reduction annually from 1980 levels.

Who benefits from free allowances depends on who gets the free allowances and in what numbers compared to their current emissions. If you give them away based on current or recent emission levels, then one could argue (as you say) that it would harm areas that have made greater reductions in emissions before the cap was set. Most new cap and trade programs try to avoid “penalizing” early action this way. One very good way to do that is by selling the allowances; another good reason for an auction. So in that sense, free allowances might been seen as reducing cap and trade’s effectiveness. Like many others, I strongly prefer and auction myself (or a carbon tax). But it is wrong to say that free allowances don’t put a price on carbon – that depends entirely on the cap level (and provisions for offsets, etc).

Let me see if I have this correct:

Say, for argument, the US begins by limiting CO2 emissions to 95% of current levels and gives all the allowances away. A power plant can invest in efficiency, shut down its oldest, least efficient boilers (reducing output), go off line for 18 days a year(again, reducing output) or, at modest annual cost, buy additional allowances from someone else. (Borrowing numbers from someone else’s comments, the additional cost, assuming allowances at $15/ton, would be about $7.5 million dollars for a 1GW plant)

Similarly, a utility with a lot of power plants could shut down its most inefficient units and transfer those allowances to its other plants or sell them to other utilities. I believe Congress intends to award free allowances according to current emissions–eastern coal plants would get relatively more because of their claim that cap and trade hurts them the most. Efficient natural gas plants in California would get fewer.

On one hand, this seems like a step backwards. On the other, we’d be encouraging utilities to retire their least efficient, most heavily polluting power plants, and paying them nicely to do so.

Is there any talk about awarding allowances per electrical output rather than current CO2 emissions? Under that scheme there would be a huge incentive for more efficient power plants.

One other thought, how will cap and trade affect New Source Review? I don’t think it’s a stretch to imagine utilities asking for exemptions from New Source Review, claiming that the investments they are being forced to make under cap and trade are already a significant burden. In a way, they’d be getting exactly what they tried to get under the Bush Administration, only this time we’d be paying them to keep polluting.

There is a perception that if credits are handed out for free, this will save money for consumers in the long run. This is, I believe, a misconception. Credits will immediately have a market value, and the recipients of the free credits will not keep them if they can make some money by selling them. One way or another, money reflecting the value of credits will change hands. The question is, who gets the money? When the credits are free, the profits stay with the company. When there is an auction, there is a pool of funds that can help, from an environmental perspective, in at least 2ways: 1. Some of the funds can be used to promote renewable energy and energy efficiency, and 2. Some of the money can be returned to consumers who might otherwise bear a disproportionate burden from higher prices for goods and services. This could help overcome some of the political opposition to cap and trade.