Taxing Carbon?

Should we adopt a corporate carbon tax? Something to think about on Tax Day.

Today is Tax Day, delayed from its usual spot in mid-April due a backlog at the IRS. It seems like an apt time to think about a carbon tax. At present, it doesn’t seem to be on Biden’s agenda, but agendas can change with circumstances, sometimes unpredictably.

Politically, the biggest problem with a carbon tax always been that it’s . . . a tax. Democrats are planning to raise some taxes anyway, however, so this might be less of a consideration. A carbon tax also has some possible support on the GOP side of the aisle and from corporations. Right now, the critical vote would probably be probably West Virginia Senator Joe Manchin, but showering enough money on his state might be enough to change his mind.

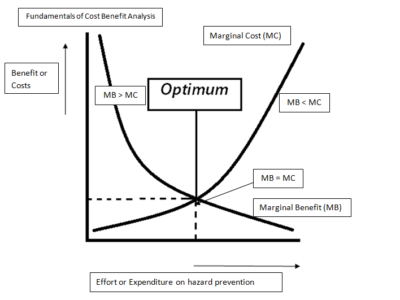

It’s certainly open to question whether a carbon tax is the ideal policy tool. It has some policy strengths. Evidence suggests that the carbon taxes already in use in nearly twenty jurisdictions do cut carbon emissions, and they may have been more effective than cap-and-trade systems. Economists like carbon taxes because they maximize industry flexibility in finding ways to cut emissions and have predictable costs.

From my perspective, the big advantages of a carbon tax don’t involve sophisticated economic analysis. The big advantages are really logistical. A carbon tax is simpler than a cap-and-trade system or conventional regulations, which makes it a lot easier to launch. A carbon tax can also be implemented much more quickly. New tax laws generally go into effect within a year, but large-scale regulations and cap-and-trade schemes can take years to implement. The timing advantage of a carbon tax is important given the urgency of climate change. Every delay translates into millions of tons of carbon.

There are also policy arguments on the other side. The tax could be too low to have any real effect on emissions. Even if the tax is high enough, additional measures would probably be needed to promote new technologies and their adoption by industry. There are also equity issues. A carbon tax would lower conventional pollution in urban neighborhoods, but perhaps not as much as more targeted measures. The tax would also be regressive, although that’s also true of conventional regulations that would raise energy costs. On the other hand, a tax would generate revenue that could be used to counter the regressive effect.

The biggest barrier to adopting a carbon tax has been the public’s aversion to imposing new taxes or raising existing ones. But a carbon tax has some advantages that might outweigh that political difficulty.

First, the Democrats need a source of money. The government already has a huge deficit, and Democratic spending plans will inflate it further. Eventually, whoever is in power is going to have to address the deficit issue. The great thing about a carbon tax from this perspective is simply that it will bring in money, which can be deployed for all kinds of useful purposes.

Second, a carbon tax would face an easier procedural path than a regulatory law or a cap-and-trade scheme. Reconciliation bills provide a viable way around the 60-vote requirement in the Senate. It was that requirement that sunk the Waxman-Markey cap-and-trade bill a decade ago. It’s conceivable that a cap-and-trade bill with auctioned allowances could qualify for reconciliation. But a pure tax measure would be more likely to pass muster with the Senate parliamentarian as a revenue measure.

Third, a key part of the GOP bill was a huge cut in the corporate tax. Like the current Biden proposal, the carbon tax could be pitched as a replacement for part of the lost corporate tax levels. Instead of calling it a carbon tax, it could be called corporate emissions tax and sold that way. It’s helpful that a carbon tax is paid by energy businesses, not individuals. Ordinary people don’t have to fill out forms, worry about withholding of wages, or write checks to the government to pay the tax.

Tax increases have been a taboo subject in American politics, but that could change. Consider the example of Kansas, where Sam Brownback pioneered the massive tax cut approach that became national with Trump’s tax cuts. Eventually, the situation became bad enough that even Republicans voted to raise taxes. And if we’re going to need a tax increase of some kind, a corporate carbon tax would be a win-win — good for the budget and good for the planet. I have no illusions about the likelihood of enacting a carbon tax right now, but the option really should be on the table.

Reader Comments

2 Replies to “Taxing Carbon?”

Comments are closed.

Domestic and foreign fossil fuel subsidies, tax credits and loopholes might counteract a carbon tax. If a government wanted to move toward a low carbon future it would end these immediately.

As a carbon tax advocate I appreciate attention on the topic.

Overall, I think your analysis is on target – a carbon tax has some big advantages that make it an effective policy tool for this moment. It is simple to set up, will drive down emissions quickly, and can easily pass through reconciliation. It is a tax on corporations – specifically the corporations that are polluting our atmosphere. Done right, it can be a progressive policy that supports our health and economic equality.

I will say I was dismayed by the opening sentence pondering whether a carbon tax is “the ideal policy tool”. No other climate policy is held up against the metric of being “the ideal policy” because no single policy will ever solve climate change. Perhaps carbon tax advocates are to blame for the perception that it might be such a singular solution, but perpetuating that notion is not serving the climate movement. All policies should be evaluated on a different metric – whether they are “a useful and effective policy tool”, one among many in the policy toolbox. A well designed carbon tax clearly meets that test.

I would also argue that the biggest barrier to enacting a carbon tax has been the resistance to all forms of effective climate action, coming primarily from those with entrenched interest in the status quo fossil fuel based systems. Maybe that is stating the obvious, but to claim that it is aversion to taxes that have prevented it’s passage ignores the main antagonist to carbon pricing and climate policy.

As we put together a bundle of policies to address climate change, it is clear to me that a carbon tax is a great tool to have as part of the mix.