Unraveling Hydrogen: Part I

The first in a series that examines the hype around hydrogen production.

For over a century, supporters of hydrogen energy have billed H2 as the fuel of the future. In his 1874 novel, The Mysterious Island, Jules Verne wrote that “water will one day be employed as fuel, that hydrogen and oxygen which constitute it, used singly or together, will furnish an inexhaustible source of heat and light, of an intensity of which coal is not capable.” Nearly one hundred years later, General Motors unveiled Electrovan, a clunky (and very dangerous) Handi-van outfitted with hydrogen fuel cell technologies similar to those deployed by the Apollo spacecraft that would eventually put the first person on the moon. In 1970, electrochemist (and purported alchemist) John Bockris predicted a global shift to the hydrogen economy, a phrase that describes widespread adoption of hydrogen to facilitate a shift to a low-carbon society. But here in 2023, how close are we to realizing these enduring promises of a hydrogen-powered future, and what might be the policy implications of our efforts to achieve this future?

Today, hydrogen technology has more momentum than ever, driven by the promise of a clean, carbon-free energy source, deployable at scales necessary to decarbonize large sectors of the economy. In 2022, hydrogen earned bipartisan support at the forefront of the national clean-energy discussion, particularly as a vehicle for decarbonizing hard-to-electrify sectors like heavy-duty trucking and shipping, or manufacturing industries like iron, steel, and cement. The Inflation Reduction Act provides tax incentives and subsidies for “clean hydrogen” production facilities, including $8 billion for “hydrogen hubs” across the U.S. Here in California, hydrogen featured heavily (probably too much) in the 2022 Scoping Plan, California’s roadmap to achieving statewide carbon neutrality by 2045. The California Legislature also recently passed AB 205 and AB 209, which require the California Energy Commission to undertake hydrogen demonstration projects and to oversee a hydrogen program that would fund projects associated with the “production, processing, delivery, storage, or end use of hydrogen.”

Utilities and energy providers have demonstrated an even greater enthusiasm for the emerging potential of hydrogen energy. LA City Council recently approved LADWP’s request for $800 million in funding to save the Scattergood natural gas plant from decommissioning by retrofitting the plant to combust a blend of natural gas and hydrogen. CPUC awarded $30 million to SoCalGas to commission an exploratory study on a hydrogen pipeline and delivery system, with many of the proposed routes originating in Nevada and terminating in Los Angeles. California also formed a public-private partnership to build out a hydrogen hub in California, called Alliance for Renewable Clean Hydrogen Energy Systems (ARCHES), aimed at getting a share of the IRA’s $8 billion in funding for hydrogen hubs.

Despite the wave of hype that has driven recent investment and policy relating to hydrogen, I’ve found that the world of hydrogen energy is complex, nuanced, and ever-changing. So, to help anyone who may be interested in unraveling the dynamic landscape of hydrogen law and policy, I’ll be preparing a series of posts to help lawyers and advocates gain a deeper understanding of this landscape. Today’s post will cover the basics of hydrogen production. In later entries, I will discuss the various use applications, necessary infrastructure, and the regulatory debates and policies that have shaped the future of hydrogen infrastructure and energy. I’ll conclude the series with some final thoughts on the environmental health and justice impacts associated with proposed projects and the buildout of hydrogen technology, with an eye toward potential projects here in California.

Before diving into our first discussion, I’ll note that I approach the conversation of hydrogen energy with some skepticism. The fossil fuel industry has been a major player in generating interest in hydrogen, particularly for technology that produces hydrogen from fossil fuels. In fact, the fossil fuel industry is both the United States’ largest producer and consumer of hydrogen; roughly 60 percent of the nation’s domestic hydrogen supply is deployed in crude oil refining. More fundamentally, when this much money and national attention are devoted to a topic––particularly one that is sometimes marketed as a decarbonization panacea––there is always a risk that marginalized voices are drowned out. With this in mind, I have tried to incorporate perspectives from community-based and environmental justice organizations wherever possible.

So, where does hydrogen come from?

Experts classify hydrogen gas using a spectrum of different colors, which act as a shorthand for the process by which the gas is derived. The range and meanings of these different colors sometimes vary and can be imprecise, but you can find a quick overview of the various colors of hydrogen here. However, for the purposes of this series, I’ll focus on three types of hydrogen production: gray, blue, and green. The method of hydrogen production makes a significant difference in its climate and environmental impacts, and so this color wheel is a good place to start this series.

First, gray hydrogen represents about 99 percent of the hydrogen produced today for industrial use, and generally refers to hydrogen derived from natural gas through a process called steam-methane reformation. Through a series of reactions––which usually take place at a refinery––steam and methane react to produce hydrogen and carbon dioxide. Under current conditions, it’s estimated that one kilowatt-hour of gray hydrogen production directly creates about 0.28 kg of carbon dioxide emissions. For comparison, the combustion of natural gas produces about 0.42 kg of carbon dioxide emissions per kilowatt-hour of energy produced. At a glance, this comparison seems favorable; however, these estimates do not account for methane leakage at the facility level, or for the energy costs of compression and transportation. In overall life cycle emissions, it’s very likely that gray hydrogen is more carbon intensive than both coal and natural gas.

The hydrogen industry’s proposed solution to gray hydrogen’s lifecycle emissions problem lies in blue hydrogen. Blue hydrogen is identical to gray in every respect, except that it employs carbon capture and storage (CCS). CCS refers to technologies that capture carbon dioxide emissions from point sources and transport them––usually via pipeline––to underground reservoirs. CCS, at small scale, has been around for many years, but the industry still has a long way to go. As of last year, it was estimated that only about 1 percent of total hydrogen production employs carbon capture, with only two commercial facilities in the U.S. producing blue hydrogen.

Blue hydrogen, despite emitting less carbon than gray, still has some major question marks around its efficacy, costs, and potential health and safety impacts. The process of capturing carbon requires a lot of energy (up to 30-50 percent of a power plant’s energy output), which usually comes from further combustion of natural gas. Moreover, even where CCS is powered by clean, renewable sources, fugitive methane emissions may create significant climate challenges for both gray and blue hydrogen. Unburned methane––a much more potent greenhouse gas than carbon dioxide––may escape at all stages of the blue hydrogen life cycle, including upstream extraction and transportation, during stream reformation, and throughout the carbon capture process. In fact, depending on rates of methane leakage and efficiency of carbon capture technology, the climate impacts of blue hydrogen may be even greater than burning natural gas and coal. These leakage rates have been disputed back and forth, but under fugitive methane estimates published by the EPA, these concerns still hold true. Opponents of blue hydrogen further argue that the buildout of the requisite infrastructure will extend the life of related fossil fuel infrastructure that would otherwise be decommissioned.

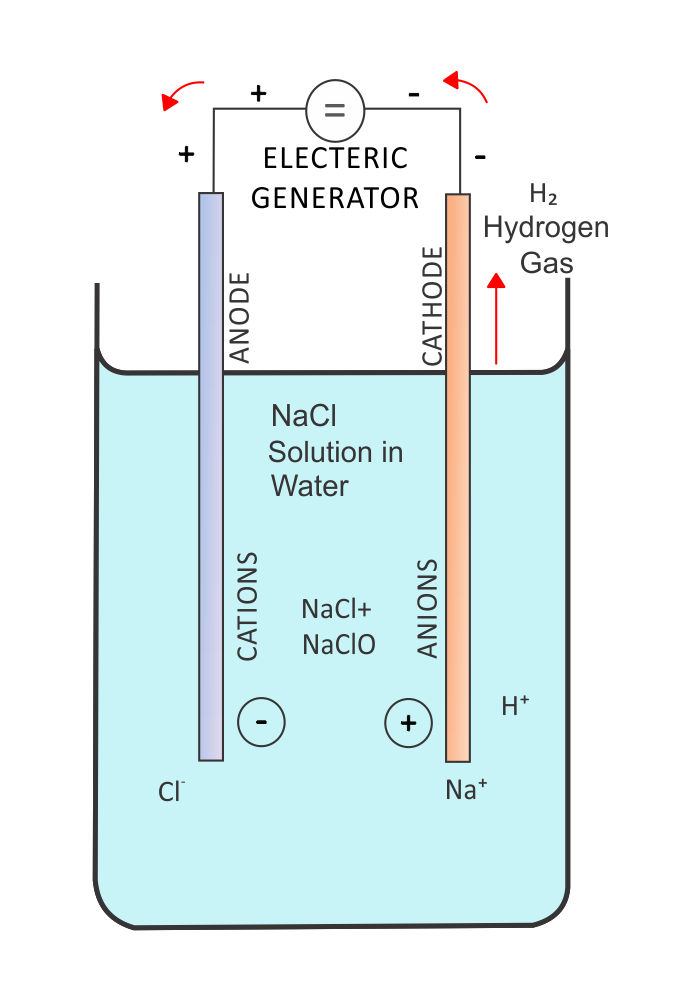

Finally, we turn our attention to green hydrogen. The definition of green hydrogen has become increasingly fraught. Almost all environmental groups argue that green hydrogen should only refer to electrolysis powered solely by carbon-free renewable energy sources. Electrolysis is a process by which electricity is passed through water, splitting it into its elemental components and drawing the newly formed hydrogen gas toward a cathode. Electrolysis is currently the only means of creating hydrogen without emitting greenhouse gases, but it’s inefficient. Between the electricity used to conduct electrolysis, compress and transport the hydrogen, and convert it back to energy, the round-trip efficiency for hydrogen falls between 18 and 46 percent (compared to about 80 percent for battery storage). As such, it is far more efficient, where possible, to expand carbon-free renewables exported to the grid, or to take advantage of more efficient storage methods, including batteries.

The hydrogen industry––and some policymakers––argue for a looser definition of green hydrogen. For instance, the Green Hydrogen Coalition (GHC), a hydrogen industry group, defines green hydrogen as “hydrogen produced from non-fossil-fuel feedstocks and emits zero or de minimis greenhouse gas emissions on a lifecycle basis.” The distinction here is important. GHC’s definition includes steam-reformation of biomethane, methane produced by the decomposition of organic matter, originating from facilities like landfills and dairy farms. Industry groups maintain that hydrogen derived from biomethane is low carbon (or even net-negative), as this methane would otherwise be deposited directly into the atmosphere. However, environmental organizations counter that crediting these operations as carbon removal––and awarding subsidies on this basis––benefits the largest, most-polluting facilities and incentivizes the creation of methane where none would otherwise occur.

Hopefully, the above information will help contextualize the broader discussion in later entries to this series. But it is not all-encompassing. The Department of Energy recently issued guidance on its Draft Clean Hydrogen Production Standard, which will be used to award hydrogen hub funding, that grounds its analysis in hydrogen’s carbon intensity, rather than any specific production method. Moreover, hydrogen technology is rapidly evolving; emerging processes and technologies like autothermal reformation or highly-efficient electolyzers may change these analyses in the future.

In the next installment: An in-depth look at the different use-cases for hydrogen energy

Reader Comments