Cap and Trade Heats Up—For Better or Worse

Prices are high and markets are proliferating as program designers lean away from the more controversial elements of carbon trading.

This past year has been big for cap-and-trade-style systems, and that momentum looks like it’s continuing in 2023. Recently, we’ve seen new programs start up in Oregon and Washington, a proposal in New York State for new carbon markets, and sustained high prices in existing programs in California and the Northeast. Although these programs differ in their details, they all attempt to reduce greenhouse-gas emissions cost-effectively by creating a market for permissions to emit—called “allowances”—subject to an overall cap on the amount of aggregate emissions allowed. So let’s take a quick look at these developments, and how new programs are responding to some of the most pressing concerns with emissions trading.

High Prices and New Programs

Washington’s “Cap and Invest” program launched this year, and Oregon’s “Climate Protection Program” issued its first allowances in March 2022, joining the three existing U.S. cap-and-trade programs: California’s, Massachusetts’, and the multistate Regional Greenhouse Gas Initiative, or “RGGI”. (Oregon’s program is a little different from the others: it covers fuel suppliers, but not power plants or industrial emitters, and all its allowances are given for free to covered suppliers, not auctioned off.)

New York, whose power suppliers already participate in RGGI, is also seriously considering starting its own carbon market. In December, the state released a roadmap for climate policy that included a “Cap-and-Invest” program, and in January Gov. Kathy Hochul proposed legislation that would give state agencies the power to make it real.

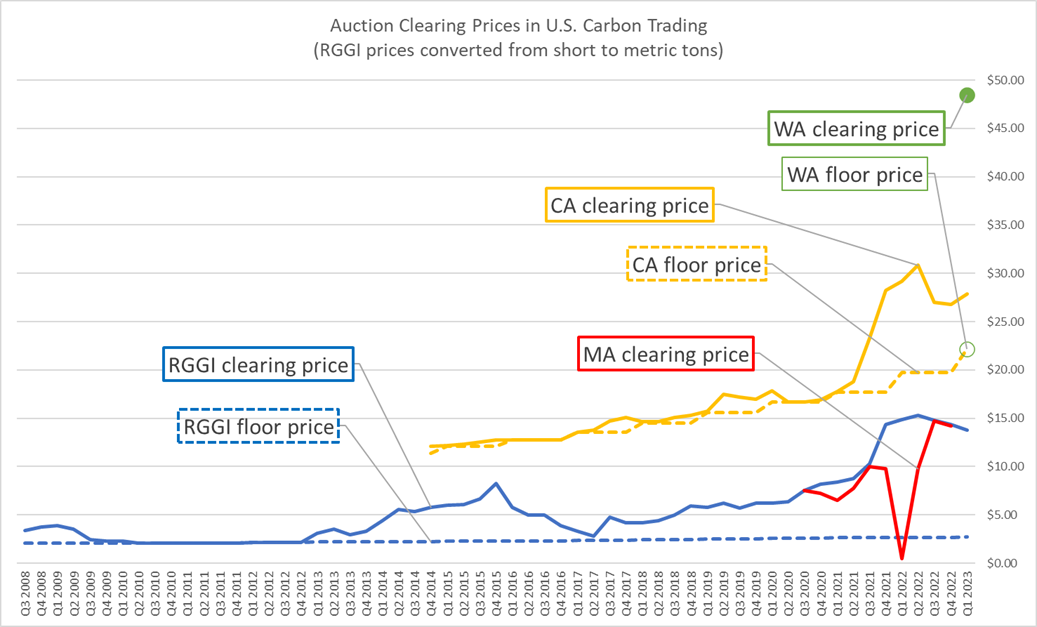

Meanwhile, allowance prices—one indicator of a carbon market’s efficacy—have remained consistently high. California’s allowance-auction prices, which had been at or near the regulatory minimum for much of the life of the program, started rising markedly in mid-2021 and have been over $25 since. Prices for RGGI allowances shot up during the same period, triggering the release of additional allowances to slow price growth. A small cap-and-trade program for power plants in Massachusetts likewise has seen high prices recently, although those are more volatile. And Washington’s first auction beat all of those, clearing at $48.50, well above its floor price of $22.20.

Evolving Policy Approaches

Meanwhile, policymakers seem to be adjusting the cap-and-trade model to account for—or evade—criticism. For one, they’ve stopped calling it “Cap and Trade”: both Washington and New York call their programs “Cap and Invest” instead. This appears to be purely superficial, since Washington’s program still allows for allowance trading, and New York’s program presumably will, too. (And, for that matter, California’s cap-and-trade program includes a major investment program.)

Still, emphasizing the funding that allowance auctions can provide to other projects, and minimizing the role of the market, reflects a growing concern with the criticism levied against carbon markets. Some environmental-justice advocates criticize market-based approaches for allowing polluters to decide whether—and where—to cut emissions; since local air pollutants are often emitted alongside climate pollutants, allowing emitters this flexibility makes it possible for them to maintain or even worsen the serious racial and economic inequities in pollutant burdens that already exist (the data on this is sparse and complicated by the fact that cap-and-trade programs tend to be paired with other programs, making the impact of any one program unclear). One response to these concerns by carbon-market proponents has been to use the funds generated by the carbon market to invest more in frontline communities: both Washington and New York have these requirements, and New York’s plan is being pitched as a way to generate funds for “communities with particular needs.” Similarly, in California, this is done through a set-aside for overburdened and “low income” communities (I’ll be explaining those scare quotes in an upcoming post in my series on income-targeted environmental policies).

Another major shift in the more recent carbon markets is reducing the role of the alternative compliance options known as “offsets.” Offsets are supposed to be a way for businesses in a carbon market to get credit for projects that reduce emissions outside the scope of the market. But recent scrutiny of offset projects in California’s market—extending a 2021 debate—have raised serious concerns that they are not actually achieving the level of emissions reductions that they claim. And because offsets allow even more flexibility in where emissions reductions—and the accompanying local benefits—occur, they are seen as part of carbon markets’ equity problem.

That may be why Oregon, Washington, and New York are limiting the role of offsets in their carbon markets. Washington’s program allows for offsets as normal, but reduces the statewide cap on greenhouse-gas emissions by an amount equal to the number of offsets used by market participants, to prevent offsets from weakening the state’s climate goals. Oregon replaces offsets with “community climate investments,” which have a direct price-to-credit ratio (currently $123 per credit), avoiding the difficulty of trying to measure the amount of emissions reductions achieved by a particular project. And New York may eliminate the use of offsets altogether: the state’s Scoping Plan noted that “the role of offsets would have to be strictly limited or even prohibited” to comply with state law, and Gov. Hochul’s office has said that her plan “will not allow the use of offsets that could allow high-emitting sources to continue to pollute.”

On the other hand, California policymakers argue that offsets are an important part of their cap-and-trade regime, both because they reduce the cost of the program by offering a cheaper alternative to allowances and because they encourage greenhouse-gas reductions in new and emerging areas. The turn away from offsets in Oregon and Washington (and, maybe, New York) may therefore be a useful experiment in policy design.

The Future of Carbon Markets?

The rollout of cap-and-trade programs in the U.S. has been slow and difficult. But as the inevitability of major climate policy becomes clear, regulators look to carbon markets to supplement other programs, and even regulated industries are beginning to see them as an alternative to stricter requirements. In that sense, it’s a good thing that carbon markets are both getting some bite—in the form of higher allowance prices—and that policymakers are learning from the past. But the equity concerns raised by carbon markets remain serious, and neither changing the name nor eliminating offsets is enough: Any state that opts for an emissions-trading system must pair it with stringent and sustained reductions in local environmental harms, targeted at the areas that are the most overburdened.

Reader Comments