How to Hedge Your Portfolio Against a Possible Trump Victory

Place your financial bets on having LESS renewable energy and MORE climate change.

If you’re worried about the economic impact of a Trump victory, you should be thinking of hedging your risk. One hedging strategy is to place a bet on climate change. By undoing Obama’s climate regulations and scuttling the Paris Agreement, Trump will set back climate policy, here and around the world by years, maybe decades, He’ll undermine renewable energy, especially wind power, which he hates. Even if a later president manages to pick up the pieces, a lot of extra carbon will go into the atmosphere in the meantime.

Yes, this is bad news, but maybe you can take advantage of it as an investment strategy. Here are some possible moves you could make:

- Clean energy stocks. An obvious one: the hedging strategy is to sell stock in these companies short to take advantage of the market drop.

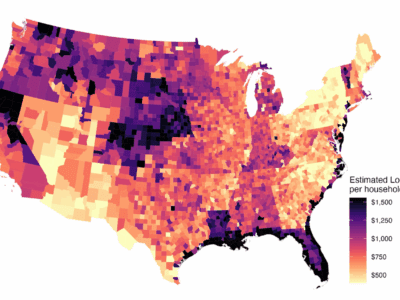

- Northern real estate. Almost as obvious: acquire options to buy land in Duluth, Anchorage, and Bangor. The climate will get milder there while the deteriorating climate will push people out of the Sun Belt. A Trump victory will amplify these trends. Someday, beachfront property on Lake Superior is going to be worth a lot of money.

- Florida real estate. Florida is the state that is likely to suffer the earliest from climate change, which Trump will make worse. People are going to start to realize that. So land values are likely to slide faster than otherwise over the coming years, especially in South Florida. If you have any land in Miami or Lauderdale, a Trump victory is the time to sell.

- Coal stocks. These are likely to go way up after Trump wins, in a wave of optimism about the industry. That optimism is misplaced. Trump also loves fracking, so natural gas prices are going to stay low and coal will remain an economically unappealing fuel. You can take advantage of the initial over-optimism and the inevitable market correction.

- Geo-engineering start-ups. A Trump victory will make controlling carbon emissions much tougher. Yet the effects are going to be getting a lot more obvious and scary. So there will be a lot of pressure in a few years to do something. Making a new international deal to cut emissions will be harder than the first time, after the U.S. has cut and run from the Paris Agreement. Geo-engineering (putting solar mirrors in space or chemicals in the stratosphere) will look like an attractive way out. Time to get in on the ground floor!

Before the SEC gets after me, I should warn you that I know almost nothing about finance. So don’t take this as serious investment advice! But what I do know is that Trump’s election would be a huge setback, possibly a fatal one, to the global effort to limit carbon emissions. At the very least, it would make the problem more severe and require more drastic measures later. That’s a risk that’s too big to hedge.

Reader Comments

4 Replies to “How to Hedge Your Portfolio Against a Possible Trump Victory”

Comments are closed.

Dan, I pray that your threat of Trump being elected POTUS causes you folks to join together at last to fight for the human race, before we run out of time.

The Coyote Principle

CALIFORNIA:

The Governor of California is jogging with his dog along a nature trail. A coyote jumps out and attacks the Governor’s dog, then bites the Governor.

The Governor starts to intervene, but reflects upon the movie “Bambi” and then realizes he should stop because the coyote is only doing what is natural.

He calls animal control. Animal Control captures the coyote and bills the state $200 testing it for diseases and $500 for relocating it.

He calls a veterinarian. The vet collects the dead dog and bills the State $200 testing it for diseases.

The Governor goes to hospital and spends $3,500 getting checked for diseases from the coyote and on getting his bite wound bandaged.

The running trail gets shut down for 6 months while Fish & Game conducts a $100,000 survey to make sure the area is now free of dangerous animals.

The Governor spends $50,000 in state funds implementing a “coyote awareness program” for residents of the area.

The State Legislature spends $2 million to study how to better treat rabies and how to permanently eradicate the disease throughout the world.

The Governor’s security agent is fired for not stopping the attack. The state spends $150,000 to hire and train a new agent with additional special training re the nature of coyotes.

PETA protests the coyote’s relocation and files a $5 million suit against the state.

————————————————–

TEXAS:

The Governor of Texas is jogging with his dog along a nature trail. A coyote jumps out and attacks his dog.

The Governor shoots the coyote with his state-issued pistol and keeps jogging. The Governor has spent $.50 on a .45 ACP hollow point cartridge.

The buzzards eat the dead coyote.

And that, my friends, is why California is broke and Texas is not.

Hillary Clinton Blames Climate Change for Hurricane Hermine:

“……Another threat to our country is climate change,” she said. “2015 was the hottest year on record, and the science is clear. It’s real. It’s wreaking havoc on communities across America. Last week’s hurricane was another reminder of the devastation that extreme weather can cause, and I send my thoughts and prayers to everyone affected by Hermine…..”

http://freebeacon.com/issues/hillary-clinton-blames-climate-change-hurricane-hermine/

BQRQ, ordinarily I ignore the stuff deniers say, but the most tragic fact of life today is that deniers are far more successful at destroying the human race while those who anoint themselves “preeminent professors” are the worst failures in history at protecting the human race.