The Shock of the Global

What the current fossil fuel energy crisis means for climate and clean energy policy

Pick up any newspaper and it is clear that much of the world is experiencing a series of interrelated energy price shocks. In Europe and the UK, natural gas prices are up by more than 500% over the last year, hitting all-time highs earlier this month. In the US, even with abundant supplies of natural gas as a result of extensive shale gas development, natural gas prices are more than double where they were a year ago. China and India are both running dangerously low on coal stocks, which has led to substantial price increases, surging imports, and forced power outages and curtailments at various industrial facilities. Global price benchmarks for crude oil have risen to $80 per barrel in the last month (double where they were a year ago) and are expected to rise even higher in the months ahead, after going negative in April 2020 during the height of the pandemic.

The disruptions caused by energy price shocks and spot shortages are now rippling through other commodity markets. Copper prices last week were closing in on their all-time high set in May of this year. Zinc hit a fifteen-year high. And aluminum prices are higher than at any time since the financial crisis of 2008. Global stocks of key metals are also at or near all-time lows, putting additional pressure on prices. Spot copper prices are currently trading at a significant premium over the three month futures contracts on the London Metals Exchange, creating what is known as a “backwardated” market, finance lingo for a market that is facing a serious supply crunch.

Global food prices are also way up compared to last year. FAO’s global food price index shows real prices hitting levels not seen since the global food crisis of the 1970s. All of which further compounds the problem of global hunger and food insecurity, which rose again last year for the seventh year in a row (with some 30% of the world’s population now suffering from moderate to severe food insecurity). While some of the recent food price increases are connected to the runup in energy prices, that is only part of the story. Indeed, the unique vulnerability of the global food system to economic shocks and climate disruption pose a set of challenges that in many respects are more serious than those facing any other sector, including energy, a topic I will return to in a future blog post.

Taken together, all of these price increases for basic commodities are feeding broader inflationary trends, canceling out wage gains and compounding the burdens facing working families and the poor as they seek to recover from the pandemic. Notwithstanding all of the ways that digital technologies are transforming our lives, the deep materiality of the global economy is once again making itself known in profound and painful ways.

There are echoes here of the energy and economic crisis of the 1970s, a global shock that has reverberated in global politics and economics for much of the last half century. The parallels are obvious: dramatic and sustained energy price shocks, a global food crisis, rising inflation, and the possibility of economic stagnation. To be sure, there are some obvious differences this time around. The current global shock associated with high energy and food prices can be attributed in part to the difficulties of adjusting critical supply chains and systems of provisioning as the global economy rebounds from the COVID-19 pandemic. Economic growth also seems to be charging ahead across much of the world. The geopolitics of energy are also quite different today than they were in the 1970s. But there is one clear parallel that is worth emphasizing: the current crisis, like the crisis of the 1970s, is a crisis of the fossil fuel energy system.

Not surprisingly, fossil fuel advocates strongly disagree with this assessment and have repeatedly argued that renewables and green energy are the culprits behind the current energy price shocks. Some have suggested that this will all create backlash against climate action that could undermine progress at the UN climate meetings in Glasgow next month. Fossil fuel supporters have been quick to say “I told you so.” One columnist in the Wall Street Journal asserted last week that it was time to ask “some big boy questions” at Glasgow about our rush to renewable energy. Big boy questions?! Really?

We saw a preview of all of this last year with winter storm Uri in Texas, when various politicians and commentators rushed to blame the crisis on frozen wind turbines. But as multiple analyses of what happened in Texas last February have made clear, renewables were a modest part of the problem and in many cases overperformed relative to coal and, especially, natural gas (see here and here).

The same is true with the current natural gas crisis in Europe and Asia, which is a crisis stemming in large part from an inability to deliver natural gas when and where it is needed. Although some have pointed to the decline in wind speeds across the UK and parts of Europe as a drain on gas supplies and the reason why gas storage is now quite low during the current shoulder months, when it should be fully topped up in preparation for winter, this is a very small part of the current crisis.

And, to be clear, no one has ever suggested that the intermittency of renewables does not have to be managed carefully. Persistent droughts can reduce the availability of hydroelectricity, as has happened recently in Brazil and parts of the western United States. Low wind can reduce the availability of wind energy. None of this is a surprise. Every serious person knows it. And electricity planners and systems operators have always factored it into their planning. Indeed, if anything the natural gas system has failed to do what its supporters have long claimed it can do: provide a flexible and reliable source of electricity to balance out the intermittency of renewables.

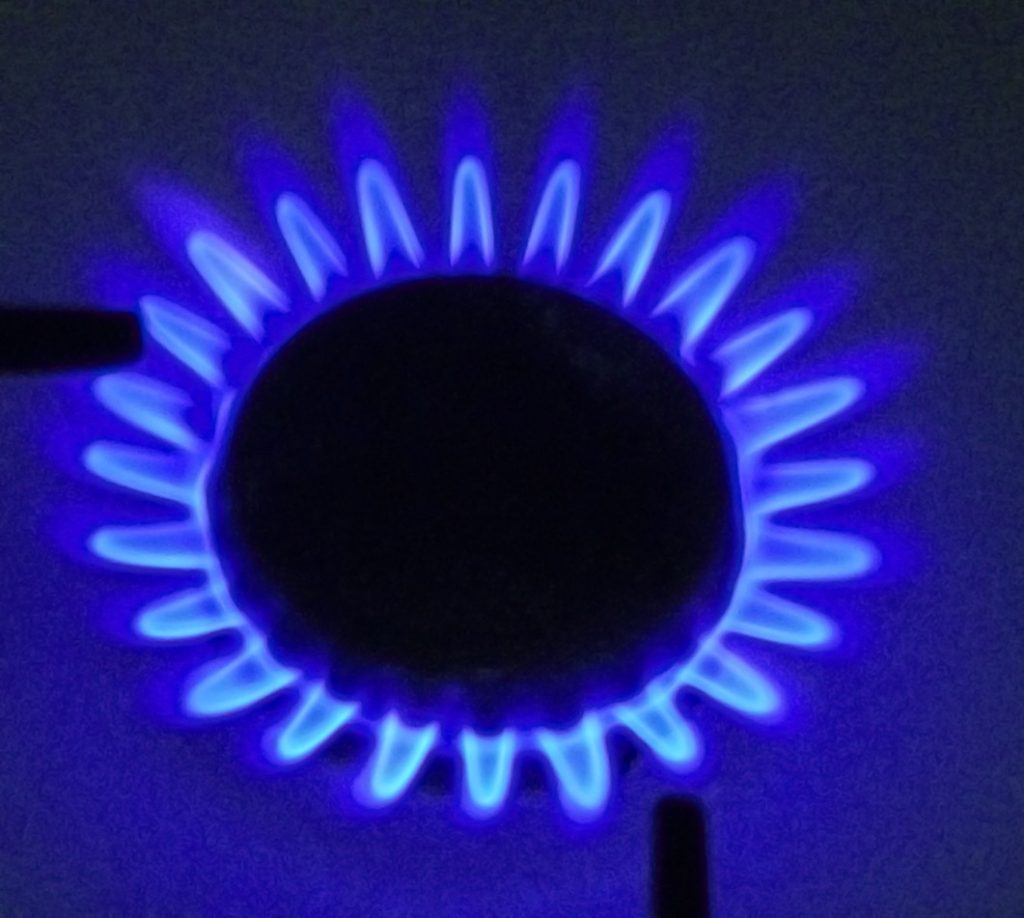

So as much as some might want to blame the current crisis on renewables and climate policy, what is abundantly clear is that we are paying the price for an energy system that has become heavily dependent on natural gas. Over the last several decades, and particularly since the shale gas boom that started in earnest in 2008, we have built an energy system that is increasingly reliant on natural gas. In the U.S., natural gas is used extensively for residential heating and cooking as well as in a wide range of industries. It is also now the dominant fuel for power generation by a substantial margin, providing roughly 40% of U.S. generating capacity, with coal, nuclear, and renewables (hydro + non-hydro) each providing about 20%. Because of the way we price electricity in our organized wholesale power markets in the U.S. and in Europe (using a uniform clearing-price auction design) and because expensive gas generation is almost always on the margin setting that clearing price, electricity prices are also going up substantially in these markets. This is especially true in the EU, where natural gas prices (as noted above) have increased substantially more than in the U.S. As a result, electricity prices in Germany and Spain are now up more than six-fold compared to a year ago.

Put bluntly, these sorts of price shocks will be with us for as long as our energy system is dominated by fossil hydrocarbons—something we have known since at least the 1970s. As the trade in natural gas goes global, with increasing movement of liquefied natural gas (LNG) around the world, regional markets will become more integrated which will in turn increase our collective exposure to global price shocks. To take one recent example, Asian spot prices for LNG are up a staggering 956% over the last year, as buyers from Europe and Asia compete to buy spot LNG cargoes in order to replenish their stocks in time for winter.

The great advantage of fossil hydrocarbons, indeed the principal reason why we have come to depend so heavily on these fuels over the last century, is their energy density and the ability to transport them over large distances. Natural gas, of course, is far more difficult (and thus more expensive) to transport than oil. But we have spent much of the last century building one of the most extensive and sophisticated infrastructures on the planet to extract and deliver fossil hydrocarbons (coal, oil, and natural gas) where and when they are needed. In the process, our economies have become highly dependent upon cheap fossil energy and quite vulnerable to price shocks for these fuels, as is happening now. We have also created a global energy system with sufficient momentum to thoroughly wreck the climate.

In addition to their obvious climate benefits, one of the great advantages of renewables such as wind and solar is that they do not have any fuel costs and they are not hostage to global markets in the way that traditional energy commodities like oil and gas are (though it is true that the global supply chains for wind turbines and towers and solar panels can be disrupted). For renewable power development, it’s all about upfront capital costs. Once these projects are built and placed in service they can generate electricity at a predictable cost that is not vulnerable to disruptions, shortfalls, and price volatility in the upstream global markets for fuels. So it is simply wrong to claim, as some have been quick to do, that the current energy price shocks (manifest in soaring prices for natural gas, coal, and oil) are somehow because of renewables or climate policy. These price shocks are a product of the fossil fuel energy system that we have built and in some ways doubled down on in recent decades. If anything, they should serve as a reminder of the urgent need to accelerate the clean energy transition.

The big question going forward is whether the current high prices will stimulate a new round of investment in assets and infrastructure dedicated to the extraction, processing, transport, and conversion of fossil hydrocarbons. So far, evidence from earlier in the year suggests some reticence to ramp up investment in fossil fuels, but it is surely too early to know how the current price shocks will affect investment.

Here is where the policy signal is critical. The IEA’s recent World Energy Outlook estimates that annual investment in clean energy projects and infrastructure will need to grow from current levels (less than $1 trillion per year) to nearly $4 trillion per year by 2030 in order for the world to have a chance of hitting the 1.5 °C target embraced by the Paris Agreement. This will take a massive step up in commitments and new policies by major emitting countries. At the same time, finance and investment for fossil fuel infrastructure cannot continue at current rates, even with the robust price signal from the current market turmoil. Yet, already we are seeing reports that China is pushing for more coal in response to the current crisis. OPEC is now bullishly projecting that world oil demand will not peak until 2035. And Senator Joe Manchin now seems to have killed the clean electricity standard that was the central plank of President Biden’s climate strategy.

Once again we have arrived at what feels like another make-or-break moment for the climate—a fork in the road where the status quo is pushing with all its might for a strategy of delay and incremental adjustment. But the stakes just keep getting higher and now more than ever politicians need to step up and reject the false narrative that the world cannot afford clean energy and aggressive climate policy. The current crisis of the fossil fuel economy serves as yet another reminder of how fossil fuels have distorted our economy and made us all vulnerable to the disruptions of global energy markets. Put that together with the deepening climate crisis and it is abundantly clear that it is past time to redouble our efforts to build a new energy economy.

Doing that while living up to the bold promises that the Biden Administration and others have made to ensure a just transition for displaced workers and communities is essential and cannot end in yet another round of empty promises and glittering generalities about green jobs. Clean energy advocates also need to get real about the sector’s abysmal track record with organized labor. And governments everywhere need to step up their assistance to low-income households to ensure access to energy and reduce the energy burden, as the EU and some of its member states are now doing in the face of skyrocketing energy prices. Future posts will dig into each of these topics, but suffice it to say for now that the pandemic and the current energy price shocks have reminded us (yet again) that energy is not just a commodity, but a key system of provisioning that is essential for everyday life—one that cannot be left to the vagaries of the market.

Winter is coming and by all accounts the world’s fossil fuel energy system will face substantial challenges in the months ahead. The lessons that policymakers draw from this latest global shock and the actions they take in response will go a long way to determining whether the world can finally get on track to achieve ambitious climate and clean energy targets by actually delivering on all the promises they have made.

Reader Comments