Addressing Extreme Heat Risk with Insurance

New report assesses potential for innovative insurance solutions to support response and mitigation

This past summer, California suffered through a record heat wave with triple-digit temperatures throughout the state that helped spark the record-setting wildfires that left millions of acres burned, thousands of people displaced, dozens dead or missing, and millions breathing toxic air. But extreme heat is a climate killer in its own right, responsible for thousands of deaths per year in the United States, a number that will grow significantly this century.

Today, CLEE is releasing a new report, Insuring Extreme Heat Risks, that studies the potential for insurance and other financial risk-transfer mechanisms to help local governments respond to and mitigate the extreme heat risk they will face with increasing regularity in coming decades. (The report was prepared with support from the California Department of Insurance and includes a foreword by California Insurance Commissioner Ricardo Lara.) While insurance is traditionally used to mitigate the financial cost of property damage after a disaster event, governments and businesses are increasingly looking to insurance as a way to address climate-related risks by supporting both recovery and mitigation efforts.

While extreme heat is similar in origin to other climate-related risks like wildfire, extreme weather, flooding, and drought, its impacts are especially diffuse and difficult to address: they fall primarily on individuals (and on our fractured, multi-payer health care system), rather than on physical property; they disproportionately affect vulnerable and disadvantaged communities; and they typically exacerbate existing health problems, making deaths and hospitalizations difficult to track.

Extreme heat affects not just physical health but also mental health, educational success, birth outcomes, worker productivity, transportation networks, and utility infrastructure. Each of these heat-related risks adds to the group of stakeholders interested in effective mitigation and response, while highlighting the challenge of organizing and paying for it. Extreme heat is a fiercely complex problem demanding comprehensive solutions that cross public health, emergency response, public works and parks, and dozens of other government capacities.

Cities like Los Angeles and San Francisco have developed resilience plans that include comprehensive extreme heat elements, often incorporating five types of infrastructure: natural (urban vegetation and tree canopy), built (cool surfaces and shade structures), social (cooling centers and air conditioner access), communications (early warning systems), and planning (zoning codes that emphasize cool development.

These strategies have the potential to substantially cool urban areas, reduce harmful health outcomes, improve quality of life, and generate significant cost savings for society. But they need policy and financial support to get off the ground.

Insurance, and the broader category of financial risk transfer, may have the potential to provide both the capital and the coordination structure necessary. In recent years, insurance and financial sector leaders have developed or adapted a range of tools to address a growing range of climate-related risks. For example:

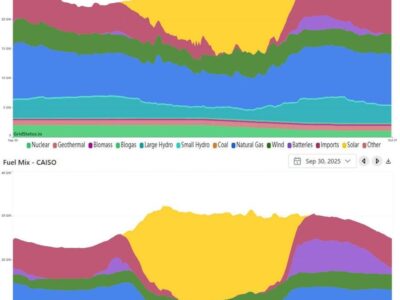

- Parametric insurance, which involves a payout based on the occurrence of a pre-determined weather/climate event (rather than assessment of actual damage), has helped national governments to recover from climate-related risks like cyclones and excess rainfall; energy providers to protect against high spot prices for fossil fuels when drought reduces hydroelectric production; and travel and tourism businesses to protect against business interruption during extreme haze events.

- The Washington, DC water authority used an environmental impact bond to finance investments in natural infrastructure to manage stormwater runoff, with contingency payments owed to investors or to the authority in case of over- or under-performance of the infrastructure.

- Forest resilience bonds can raise capital for forest restoration projects based on the anticipated ecological and wildfire protection benefits of sustainable forest management, with stakeholders including water utilities and mission-oriented investors.

Perhaps most prominently, the government of Quintana Roo, Mexico partnered with an insurer, a nonprofit, and local resorts to fund a trust that purchases a hurricane wind-based parametric insurance policy and uses the policy payouts to finance recovery of the coral reef along the state’s coastline—bringing multiple public and private stakeholders together over their shared interest in natural infrastructure, supporting resilience investment and disaster recovery.

Extreme heat poses an even greater challenge, due to the complex web of stakeholders and mitigation measures described above and the lack of a single government entity with responsibility or capacity to manage it. But the policy tools that these innovative instruments offer—including multi-jurisdiction risk pooling, incentives for risk mitigation and crisis management investments, and public-private partnerships—have the potential to form a workable risk transfer framework for extreme heat. This framework might include:

- Development of a comprehensive local extreme heat plan including appropriate components across natural, built, social, communications, and planning infrastructure.

- Analysis of financial implications of heat plan implementation including the cost of mitigation investments and responses; anticipated temperature reductions; expected health impact of social and communications investments; and estimated savings generated by these measures.

- Certification of the heat plan through a model “performance contract” that identifies necessary plan components and monitors achievement of key milestones and adherence to recurring plan elements.

- Establishment of a local heat vulnerability index including multiple trigger points at different daytime and overnight temperatures and time periods in multi-day extreme heat event.

- Creation of an insurance policy with payouts linked to heat triggers, vulnerability indicators, and appropriate responses from the heat plan, to provide financial support where and when it is most needed.

- Provision of premium discounts or other subsidies for investment in and maintenance of long-term heat mitigation infrastructure.

Significant research and policy development, from more detailed data on the societal cost of extreme heat events to new public heat management authorities and public health protections, will be needed to support this framework. (California is already a leader in one aspect of the policy department: Cal/OSHA regulations require outdoor employers to provide cooling breaks on high heat days. Senators Kamala Harris and Sherrod Brown recently introduced federal legislation that would function similarly.) Smaller-scale pilot projects focused on individual aspects of extreme heat mitigation and response by a local hospital system or outdoor industry sector could provide initial proof of concept and build the necessary coalition.

While the questions currently outrank the feasibility of risk transfer for extreme heat, the need—with heat records falling worldwide amid multiple cascading disasters, and governments ill equipped to protect their most vulnerable residents—is self-evident.

Download the report here.

Reader Comments