What Does the CBO Report on Waxman-Markey Actually Mean?

The Congressional Budget Office issued its report on the Waxman-Markey bill recently. The Washington Times immediately trumpeted: “CBO puts hefty price tag on emissions plan: Obama’s cap-and-trade system seen costing $846 billion.”

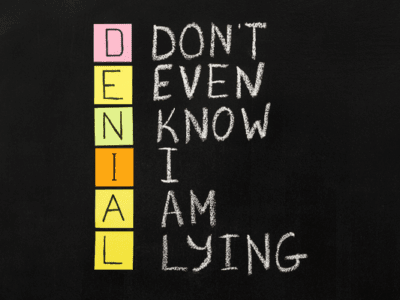

This is quite misleading. Actually, the CBO report tells us virtually nothing about the economic costs of the bill or how much consumers will be out of pocket. In fact, the way most people understand the idea of a budget deficit, it doesn’t really say much about about that either. CBO’s analysis is based on some very technical accounting that may have little significance one way or another to anyone except accountants.

CBO’s job is to project the bill’s effect on the federal budget. Here’s the bottom line, which is what the Washington Times story was reflecting:

CBO estimates that implementing this legislation would result in additional revenues, net of income and payroll tax offsets, of $253.2 billion over the 2010-2014 period and $845.6 billion over the 2010-2019 period. We estimate that direct spending would increase by $241.3 billion and $821.2 billion over the same periods, respectively.

Those sound like really big numbers (though less so on annual basis), but the numbers don’t mean what they seem to.

There’s an important point that many readers may miss: “Those changes in revenues and direct spending would mainly stem from the process of auctioning and freely distributing allowances under the cap-and-trade programs established under this legislation.” When the government creates an allowance, CBO counts that as creating a government asset; giving it away free counts the same as spending an equivalent amount of cash.

Thus, most of these revenue and expenditure numbers from CBO don’t involve cash or issuing T-bills as debt. CBO says the government will actually have only about $49.9 billion over the 2010- 2019 period in additional discretionary spending. Mostly, the “expenditures” consist of giving away free allowances. CBO estimates a total value of $973 billion of allowances sold or given away over a decade, of which something like twenty percent will be sold, which would mean something like $200 billion in income. So from a cash point of view, the effect on the budget appears to be even better than CBO portrays it.

CBO’s approach seems logical from an accounting point of view. But if you’re worried about how the deficit could affect interest rates or exchange rates, the cash figures would seem to be more relevant. If the Chinese are worried about our deficit, they’re not likely to care much one way or another about the theoretical accounting treatment of allowance give-aways. The government’s creditors should like Waxman-Markey better than CBO does.

In some ways, the CBO Report is most useful in ways that don’t directly relate to the federal budget. I’d like to spend a bit of time on these incidental aspects of the report.

Besides having an excellent summary of the bill, the CBO report contains other useful information. First, the “base” of the allowance program is broad. CBO estimates that about 7,400 facilities would be affected by the cap-and-trade programs established by the bill. According to CBO’s estimates, the programs would cover about 72 percent of U.S. emissions of GHGs in 2012, about 78 percent in 2015, and about 86 percent in 2020.

The second thing to notice is the price of carbon. CBO estimates that the price of GHG allowances would rise from about $15 per mtCO2e of emissions in 2011 to about $26 per mtCO2e in 2019. One ton of carbon produces roughly three tons of CO2, so this is equivalent to a carbon tax of between $45 and $78 per ton. But CBO also makes it clear that these are soft figures because the models aren’t very robust.

Third, offsets have a big impact on costs. CBO estimates that covered entities would use international offsets in lieu of about 190 million allowances in 2012 and in lieu of about 425 million allowances in 2020. Together, the provisions allowing the use of domestic and international offsets would decrease the price of GHG allowances by $35 (69 percent) in 2012.

One final thing: CBO nowhere gives an estimate of the total cost of compliance to industry. We know the marginal cost of compliance from the allowance prices, but the average cost from the cap-and-trade program itself should be lower. (On the other hand, some allowances will be freed up from compliance with other regulatory mandates, which may be expensive.) From the consumer point of view, the biggest question is probably how much of a decrease in the availability of energy takes place, since that’s what will drive up prices in competitive markets. CBO doesn’t tell us that either.

And of course, CBO doesn’t say a word about the environmental benefits of mitigating greenhouse gases, because those benefits are off-budget.

The moral of this story: Don’t Confuse Accounting Budgets with Real Economic Impacts.

A version of this posting appeared on the CPR blog.

Reader Comments

One Reply to “What Does the CBO Report on Waxman-Markey Actually Mean?”

Comments are closed.

The biggest problem with the economics of the Waxman-Markey is not the cost so much as the fact that it offers no guarantee that successful implementation would result in even a minor measurable reduction in global atmospheric temperature.

If all of the proposed carbon dioxide regulation strategies were implemented, it would only control a miniscule and insignificant amount of carbon dioxide emissions when compared to emissions from natural sources and the total amount of carbon dioxide that is resident in the atmosphere and oceans.

There is no scientific proof that regulating small and insignificant quantities of carbon dioxide emissions from human activities would have any measurable impact on atmospheric temperature. The huge cost of regulation can not be justified in the absence of such proof, especially in a poor economy.

Given the scientific uncertainities over the role of carbon dioxide in climate change, any climate “benefits” are purely speculative and can not be proven or guaranteed, and are unlikely to ever be realized.

This is why the economics of cap & trade, carbon taxes, sequestration and other such proposals, have been accurately described as “all costs and no benefits.”