Waxman/Whitehouse carbon tax draft

On Tuesday, Representative Waxman, Senator Whitehouse, Representaive Blumenauer and Senator Schatz released their proposal for a carbon tax bill. They are currently seeking feedback on the draft proposal, which is accordingly short on details.

The Waxman/Whitehouse proposal is to require downstream emitters (mainly power plants and other emitters) to purchase annual “carbon pollution permits” per ton of carbon-equivalent emissions in a given year. These permits will start at somewhere between $15 and $35 per ton (yet to be decided) and increase at a “real rate” (taking inflation into account?) of between 2% and 8% each year (again, yet to be decided).

The permits are not tradable or bankable unless deemed so by the Secretary of the Treasury. So do not be fooled by the phrase “pollution permit”; this scheme is a carbon tax on downstream polluters, not a cap-and-trade program.

The bill wisely focuses on those entities who already have to report greenhouse gas emissions under an EPA reporting rule. The authors claim their draft bill would require approximately 7,000 facilities to pay the fee (emitters under 50,000 metric tons per year are omitted), which would cover nearly 90% of total U.S. greenhouse gas emissions.

The authors take some (implicit) shots at the Sanders/Boxer carbon tax proposal, saying that taxing carbon upstream (at production or first sale) would be “impractical.” I am not convinced that is the case because there just are not that many fossil fuel producers and the U.S. already manages complicated taxing structures for imports and exports.

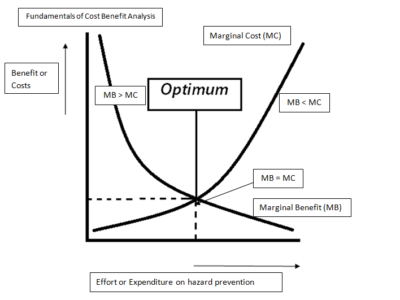

More importantly, I think a carbon tax makes more sense when looking upstream, as a way to send a price signal on carbon throughout the U.S. economy. When looking downstream at large emitters, a cap-and-trade program starts to look more promising than a tax. In that respect, the Sanders/Boxer carbon tax has the advantage because it is looking to tax upstream production. Furthermore, cap-and-trade scheme avoids the rather unanswerable question asked by the Waxman/Whitehouse team: “What is the appropriate price per ton for polluters to pay?” (The answer, for preventing climate change, is the amount necessary to prevent a catastrophic increase in greenhouse gas concentrations. That specific amount is admittedly still unknowable, but nevertheless a great deal less unknowable than the price.)

Curiously, the Waxman/Whitehouse bill gives the role of bill collector to the Secretary of the Treasury. In the “dream on” category, Section 7 of the bill requires the Secretary of the Treasury and the EPA Administrator to, within 3 months of enactment, enter into an MOU to “provide for coordination . . . and ensure that covered entities do not experience conflicting or unnecessarily duplicative mandates.” I doubt Rep. Waxman is idealistic (naïve?) enough to believe that giving a larger role to Treasury, instead of EPA, will placate House Republicans.

As with Sanders/Boxer, the Waxman/Whitehouse proposal will somehow give the proceeds of the carbon tax to the American people. Here the proposal gets a bit vague and is likely to be completely overrun with special interests. It already counts as “returning revenue,” among other things, “reducing the Federal deficit,” “protecting jobs,” and “reducing the tax liability for individuals and businesses.” If you find yourself with a job in a vulnerable, energy-intensive industry, what you need is not job protection but rather job retraining. And whatever happened to simply writing every U.S. resident a check from the proceeds? Hey, it’s good enough for Alaska…

Reader Comments

2 Replies to “Waxman/Whitehouse carbon tax draft”

Comments are closed.

Rhead said:

“…If you find yourself with a job in a vulnerable, energy-intensive industry, what you need is not job protection but rather job retraining…”

Dear Rhead,

We both know that the majority of the American people will reject and repudiate a carbon tax. We all live energy-intensive lifestyles and we all know that climate doomers have no intention of backing up their hysteria with affirmative personal action such as parking their cars and turning off their lights.

America needs more young people training for jobs in the oil and gas industry because this is far more realistic (and likely to happen) than a silly carbon tax.

Rhead said:

“…If you find yourself with a job in a vulnerable, energy-intensive industry, what you need is not job protection but rather job retraining…”

Dear Rhead,

We both know that the majority of the American people will reject and repudiate a carbon tax. We all live energy-intensive lifestyles and we all know that climate doomers have no intention of backing up their hysteria with affirmative personal action such as parking their cars and turning off their lights.

America needs more young people training for jobs in the oil and gas industry because this is far more realistic (and likely to happen) than a silly carbon tax.